-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Anyone else tracking the growing # of countries leaving the US Dollar?

- Thread starter teddy12b

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

manifest destiny

Master

Uh-oh. US dollar collapse incoming. Unless we start dropping bombs, of course. Bombs fix everything. For a while anyway. I only half joke.

You're not entirely wrong either.Uh-oh. US dollar collapse incoming. Unless we start dropping bombs, of course. Bombs fix everything. For a while anyway. I only half joke.

You are not wrong…Uh-oh. US dollar collapse incoming. Unless we start dropping bombs, of course. Bombs fix everything. For a while anyway. I only half joke.

Uh-oh. US dollar collapse incoming. Unless we start dropping bombs, of course. Bombs fix everything. For a while anyway. I only half joke.

I'd guess less than 5% of Americans have any clue what the collapse of the petrodollar will mean.

If the masses had a clue what their lives will be like after the petrodollar falls, they'd be begging the .gov to start dropping bombs.

Who is president, who controls congress, the SCOTUS, EVERYTHING else people get worked upped about pales in comparison to what the petrodollar means in our daily lives.

Interest rates, tax rates, .gov spending, the stock market, our basic standard of living is all completely dependent on it.

Keith_Indy

Master

I'd guess less than 5% of Americans have any clue what the collapse of the petrodollar will mean.

If the masses had a clue what their lives will be like after the petrodollar falls, they'd be begging the .gov to start dropping bombs.

Who is president, who controls congress, the SCOTUS, EVERYTHING else people get worked upped about pales in comparison to what the petrodollar means in our daily lives.

Interest rates, tax rates, .gov spending, the stock market, our basic standard of living is all completely dependent on it.

Yep, and on the eve of Americas downfall, let's spin some goldy oldies...

100% on point.I'd guess less than 5% of Americans have any clue what the collapse of the petrodollar will mean.

If the masses had a clue what their lives will be like after the petrodollar falls, they'd be begging the .gov to start dropping bombs.

Who is president, who controls congress, the SCOTUS, EVERYTHING else people get worked upped about pales in comparison to what the petrodollar means in our daily lives.

Interest rates, tax rates, .gov spending, the stock market, our basic standard of living is all completely dependent on it.

We’re in trouble.

indyguy333

Plinker

Turns out other countries don’t like having another country being able to sanction them for having different values. Who would have guessed? I don’t blame them one bit. We’ve abused and misused the status our grandfathers created for us. We weaponized the dollar’s reserve currency status to bully other countries, and they’re sick of it.

manifest destiny

Master

Since we're only talking about opinions, I'll offer mine. If the US dollar loses reserve status, our money becomes worthless in any affective sense. When we hear a loaf of bread in Mexico cost 10,000 pesos, we think 10,000?!? Holy cow! We might want to get used to the idea of a loaf of bread costing thousands in US dollars. Nobody will want our money. We won't be able to pay our debts (we're not going to anyway, but for different reasons). I believe, and I can be 100% wrong, that bombs and a digital currency will be America's way of dealing with a dead dollar. If we blow up enough **** and install a digital currency, we might, might, be able to maintain our historical global hedgemony. Short answer - without the petro dollar/reserve currency/financial hedgemony our dollars will be used as kindling because real kindling will be worth more.Whats this do to the dollars value. 50% drop? 75% drop? I hear lots of opinions thrown around online.

snapping turtle

Grandmaster

Currently and for the foreseeable future the US dollar (FUSA) is still the best looking horse in the glue factory.

Well...Currently and for the foreseeable future the US dollar (FUSA) is still the best looking horse in the glue factory.

"There are also other currencies that are partially or fully backed by gold, such as the Swiss franc, the Chinese yuan,Russian ruble, and the Singapore dollar. Some countries also have gold-backed cryptocurrencies, such as the Royal Mint Gold (RMG) and the Perth Mint Gold Token (PMGT)."

The problem of course is exchanging any of them. To say we are the best looking horse in the glue factory kind of ignores the wolves circling the plant looking for scraps.

I may have been mentioning something about this happening for awhile,trying to get people to prepare. At 33T in debt not counting liablities,and on the way to a CBO projected 50T in debt with 1T a year+ in just interest we are in for a rough ride. https://www.indianagunowners.com/threads/stocks-gold-silver-and-the-printing-press.111081/

*Side note. I sold all treasuries I owned including TIPS shortly after the FED started raising rates. Even with the increased interest they are still just a more slowly sinking ship.

Just another opinion, but here's mine. The only value the US dollar ever had, even when backed by gold, was "purchasing power" as a currency. Right now the purchasing power of your currency will allow you to go to walmart or name your big box store of choice and buy cheaply produced goods from all over the world for very affordable prices. Supply of those goods are currently very high. Look at what you can still get on amazon for next to nothing shipped to your door overnight. When the dust has settled and the US is done being the world's currency pimp the rest of the world is going to have other options available to them that weren't previously there.Whats this do to the dollars value. 50% drop? 75% drop? I hear lots of opinions thrown around online.

This could be something that helps Americans start to focus on our debt as a nation, but that'd mean we have to have politicians sell financial responsibility and living within our means to a nation whose population is hooked on credit cards and think if they can finance something that they can afford it. I don't see it being a popular campaign slogan when most folks don't look that far ahead.

So while the rest of the world is getting away from whatever controls the US dollar put on them, and politicians aren't likely to sell responsibility to masses of people I think what'll likely happen are some really hard times. I'm thinking worse than the '08 recession, but not quite as bad as the great depression. One glimmer of hope that we have is that the US economy is a great consumer of foreign goods, and we're more than capable enough to produce what we need to sustain ourselves. I don't think it'll be the end of the US as a nation, but I think we can expect to see hard times, and a return to focusing on being able to produce more of what we consume ourselves.

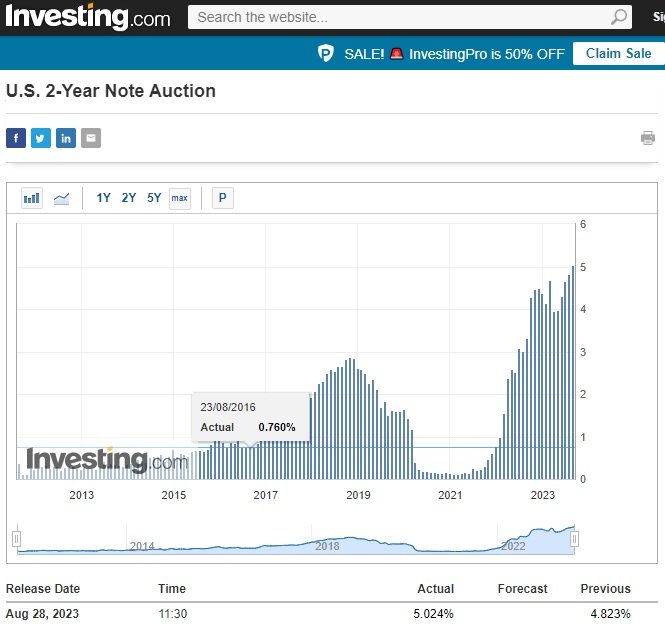

United States 2-Year Note Auction

Get the 2-Year Note Auction results in real time as they're announced and see the immediate global market impact.

Reality is making an appearance in treasuries. The FED has reduced purchases of them, but not outright stopped. It is still risky to buy them for everyone though,as a rate increase makes them less valuable and it looks like that is going to happen. However, when the fed cut rates they would gain in value. The question is will they be able to cut rates without destroying the value of the dollar and causing massive inflation as billions of dollars return to the USA.

China Is Selling Off US Treasuries During Bidenomics "Successes"

TweetTreasury Secretary Janet Yellen was questioned about China suddenly dumping $859B US treasuries (due to the war). The U.S. knew this was coming. That is why they have restricted the dollar supply by destroying crypto exchanges, raising interest rates, and holding trillions waiting to...

The claim on many financial sites and news media that China is selling to prop up the Yuan. The reality is they have been net sellers for 3+ years and have been gradually reducing exposure to them.

I have been accused of being a hard man sometimes.

I think we should immediately stop sending aid to countries that join in to destroy the dollar. We need to quit subsidizing all the shipping and postage with Red China. Any nation joining this party should be forced to settle any delinquent debts they have with us.

We should not continue to feed, clothe, arm and protect nations that are attacking us in any way.

I think we should immediately stop sending aid to countries that join in to destroy the dollar. We need to quit subsidizing all the shipping and postage with Red China. Any nation joining this party should be forced to settle any delinquent debts they have with us.

We should not continue to feed, clothe, arm and protect nations that are attacking us in any way.

manifest destiny

Master

You could talk me into this pretty easily. At least for a period of time.I think we should immediately stop sending aid to countries

What about the debts we have with them?Any nation joining this party should be forced to settle any delinquent debts they have with us.

BehindBlueI's

Grandmaster

- Oct 3, 2012

- 25,897

- 113

Why is the Euro not worthless? Why does one not need tens of thousands of Euros for a loaf of bread, and why would the USD become such a currency given anything that's happening at the moment?

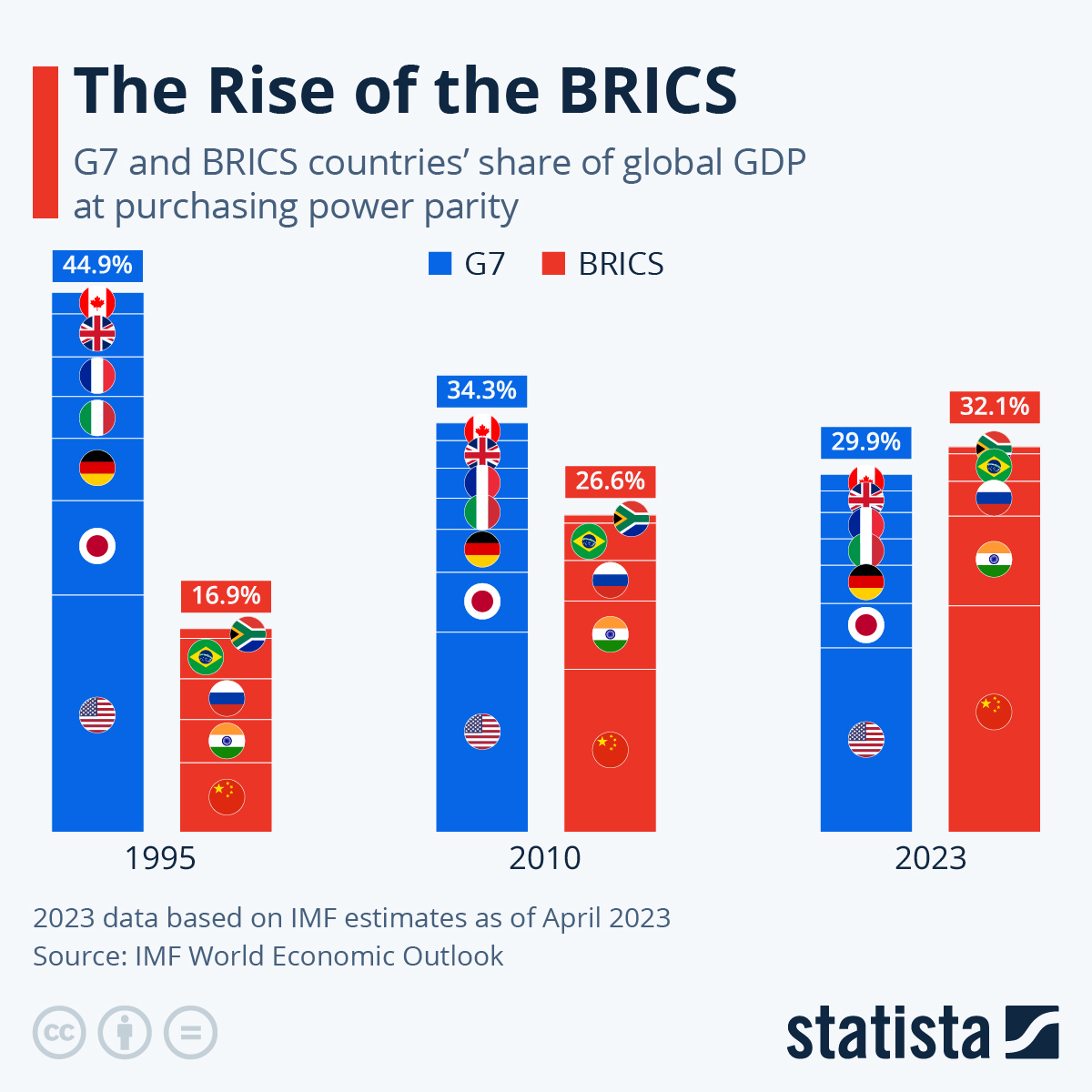

How much economic clout can BRICS wield, remove China and the remaining nations can't touch California's GDP, let alone the US GDP.

Does anyone notice China's economy is stalling and may be edging into deflation, a problem that crushed Japan's economy after wildfire growth? Remember when Japan was the economy that was going to dethrone the US? If you're in your late 30s or older, you should. Could China's selloffs be more about China than about the US?

How has the Yuan faired against the USD over any given 12 month period over the past decade? Last year? Last 6 months?

Is anyone paying attention to what India is saying and doing? That they want to strengthen the Rupee and that the US Dollar is going to be the default for the foreseeable future. Does India *want* a stronger China?

Anyone notice US oil production is at record highs?

Anyone paying attention to what billion dollar funds are doing? Are entities with real clout screaming for the exits on either side of this?

Not here to argue, don't care about responses. Just something to think about and look in to before you decide it's different this time and this is the time the sky really falls and especially before you move investments around in response.

How much economic clout can BRICS wield, remove China and the remaining nations can't touch California's GDP, let alone the US GDP.

Does anyone notice China's economy is stalling and may be edging into deflation, a problem that crushed Japan's economy after wildfire growth? Remember when Japan was the economy that was going to dethrone the US? If you're in your late 30s or older, you should. Could China's selloffs be more about China than about the US?

How has the Yuan faired against the USD over any given 12 month period over the past decade? Last year? Last 6 months?

Is anyone paying attention to what India is saying and doing? That they want to strengthen the Rupee and that the US Dollar is going to be the default for the foreseeable future. Does India *want* a stronger China?

Anyone notice US oil production is at record highs?

Anyone paying attention to what billion dollar funds are doing? Are entities with real clout screaming for the exits on either side of this?

Not here to argue, don't care about responses. Just something to think about and look in to before you decide it's different this time and this is the time the sky really falls and especially before you move investments around in response.

manifest destiny

Master

The Euro and U.S. dollar are very close in value. I don't think that changes much about the possibility of outcomes when nations agree with one another to do business without/instead of using the U.S. dollar.

The U.S. dollar compared to the Yuan looks very strong.

I wonder why the U.S. buys everything (seemingly, practically) from China and not Europe? What if China says, "Hey, U.S. pay us in Yuans."? Or really any other currency other than the dollar. Does that change the equation in your mind? Really the debate isn't about strength of currency currently. The debate is about the strength of our currency when other nations don't use it, buy it (our debt), invest in it or accept it at all. It isn't here yet, completely at least. But the process has begun.

The U.S. dollar compared to the Yuan looks very strong.

I wonder why the U.S. buys everything (seemingly, practically) from China and not Europe? What if China says, "Hey, U.S. pay us in Yuans."? Or really any other currency other than the dollar. Does that change the equation in your mind? Really the debate isn't about strength of currency currently. The debate is about the strength of our currency when other nations don't use it, buy it (our debt), invest in it or accept it at all. It isn't here yet, completely at least. But the process has begun.

BehindBlueI's

Grandmaster

- Oct 3, 2012

- 25,897

- 113

I wonder why the U.S. buys everything (seemingly, practically) from China and not Europe? What if China says, "Hey, U.S. pay us in Yuans."? Or really any other currency other than the dollar. Does that change the equation in your mind? Really the debate isn't about strength of currency currently. The debate is about the strength of our currency when other nations don't use it, buy it (our debt), invest in it or accept it at all. It isn't here yet, completely at least. But the process has begun.

Just for clarity, that chart shows the Yuan *falling* vs the USD and the Euro *gaining* vs the USD. Any country holding Chinese currency over US currency would have lost 6% of their value. This is not a sign of a world convinced China is ascending in prominence on the global economic stage. The process "begun" over a decade ago and has sputtered ever since. The doomsday prophet would have you believe that the USD is widely accepted because it's the petro-currency. That's obviously false, given the USD was widely accepted for global transactions and accounting prior to the petro-dollar. The USD was selected *because* it was so widely accepted and allowed to flow freely. Same reason Euro currency is strong despite not being a petro-currency. It's investable, it's governed by rule of law, and it's issued by a large economic engine.

Japan was supposed to eat our lunch some 30 years ago or the Arabs were going to crush our economy some 40 years ago(strangely enough by dumping US debt and manipulating petrodollars, nothing new under the sun).

China is a significant portion of our trade, no doubt, but it's far from our only source. We trade more with Mexico and Canada than China. We trade with Korea, Japan, and Germany (combined) as much as we do China. I've not broken out Taiwan from mainland China, either.

China doesn't hold all the cards and can't just make unilateral demands. We are also a significant portion of their economy. An economy that's starting to sputter and moving in to deflationary territory. Do you think they can afford to alienate the US and EU and survive the massive economic downturn that would cause at home? I don't. I could be wrong. I could live to regret my continued investment in the US economy and USD. But I do know my net worth is significantly higher now then it would have been had I bought into the calls to eject from both over the course of my working lifetime and put it all in silver or Yuan or whatever.

Members online

- Jmtbug21

- mcapo

- mondoreli

- 762god

- duanewade

- TheGrumpyGuy

- indyblue

- Fire Lord

- IndianaJosh

- AlVine

- Life Member

- Titanium_Frost

- CopperheadL

- Mikey1911

- shibumiseeker

- Doug

- parson

- Work

- migunner

- MC1983

- KJQ6945

- ECS686

- Timjoebillybob

- sloughfoot

- Damdamdon

- BE Mike

- bwframe

- Colt556

- Fixer

- led4thehed2

- aclark

- Mgderf

- Irish354

- mmpsteve

- gregr

- kotaoz

- printcraft

- indyartisan

- way2good4u95

- dieselrealtor

- Alamo

- Bh1917

- 5point9

- TacOpsGuy320

- knutty

- natdscott

- Jin

- XDragon117X

- sescbo

- Gunguy317

Total: 1,727 (members: 216, guests: 1,511)