80:1 is typical norm, at least for the last couple decades. It’s a push, about even trade premium considering. Closer to ~50:1 trade silver to gold. ~100:1 trade gold to silver. I’m not a financial advisor it’s just my bench marks. You have to find out where your comfort level is. Good luck what ever you do.

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is Silver next?

- Thread starter Magyars

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

I seem to recall the ratio being in the mid 60:1 to 70:1 range in the pre-pandemic times. Of course it was in the 90s for a bit not long ago. As other have said it is a relationship between spot prices, nothing more. Use it as you will.

dieselrealtor

Master

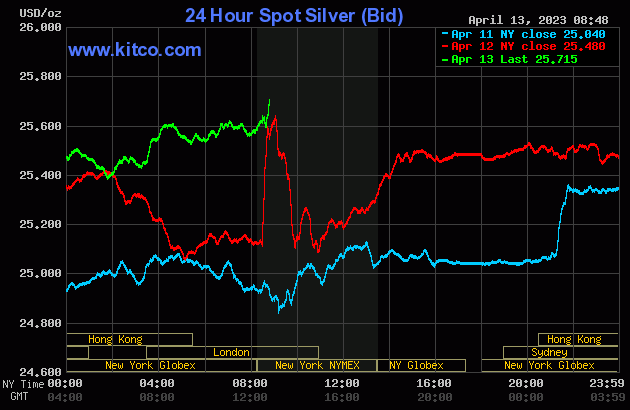

Upward trend holding today. Ratio is around 79:1. I think a more realistic ratio for a buyer's or investor's perspective is a comparison of finished products. I consider both. Below is a table of ratios for common sovereign coins found at Monument. The silver coin prices are for 20+ coins.

| 4/13/2023 | Maple Leaf | Britannia | Eagle | Averages |

| Silver | $ 32.77 | $ 30.46 | $ 40.56 | $ 34.60 |

| Gold | $2,151.19 | $ 2,131.19 | $ 2,162.89 | $ 2,148.42 |

| Ratio | 65.6:1 | 70.0:1 | 53.3:1 | 62.1:1 |

Last edited:

dieselrealtor

Master

Just my two cents. Buying physical bullion and investing in paper contracts are two entirely different things. The ratios given on some tracking sites are for contract purposes. For instance futures markets. They can be usefull for individuals that trade physical if you are practical and take premiums into account, as your charting points out.Upward trend holding today. Ratio is around 79:1. I think a more realistic ratio for a buyer's or investor's perspective is a comparison of finished products. I consider both. Below is a table of ratios for common sovereign coins found at Monument. The silver coin prices are for 20+ coins.

4/13/2023 Maple Leaf Britannia Eagle Averages Silver $ 32.77 $ 30.46 $ 40.56 $ 34.60 Gold $2,151.19 $ 2,131.19 $ 2,162.89 $ 2,148.42 Ratio 65.6:1 70.0:1 53.3:1 62.1:1

Any body that has read my posts in this thread has read my views many times, in my opinion only, Physical bullion is for multi generational storage of wealth, paper silver (futures contracts) is for investment purposes. I’ve grown my stack by trading physical only. With no out of pocket cost for several decades. If you don’t hold it, you don’t own it.

I stopped buying out of pocket long ago. My dollar cost avg. for silver is ~11.00 oz. I don’t recall if I did a DCA on gold but I stopped buying when gold was ~ 600.00 oz. I (we) keep metal as part of our investment portfolio, along with land, real estate, and a few other things with intrinsic value for our future generations. Again I’m not in any way an investment advisor, this is just the way I do things. YMMV. And best of luck to all.

nonobaddog

Grandmaster

Would somebody please explain to me how this makes any sense at all...

That is from..."Megan Horneman, chief investment officer at Verdence Capital Advisors, says that her firm has hedged its portfolio in cash. A well-known haven, cash is a better alternative to other perceived safe spots like gold, which tends to be volatile and run up too fast, she said."

Just a guess, if it‘s US cash, it’s not as volatile and no premium over spot. Also guessing it’s not parked in cash for long term. Inflation being what it is. It will soon go to some form of paper product. Stocks or some such. Again just a wild guess.Would somebody please explain to me how this makes any sense at all...

That is from...

nonobaddog

Grandmaster

The article was about how to protect your portfolio. It seems to me that cash does absolutely nothing to protect against inflation.Just a guess, if it‘s US cash, it’s not as volatile and no premium over spot. Also guessing it’s not parked in cash for long term. Inflation being what it is. It will soon go to some form of paper product. Stocks or some such. Again just a wild guess.

Understood, but all financial planners will suggest keeping some liquidity for “a good deal” if one presents itself. And at this time the paper markets are very volatile. Look at treasury bonds, where banks leverage there money. As I said I was only guessing. Only attempting to answer the question posed. I’m often mistaken. And not a bit afraid to admit it. Best of luck.The article was about how to protect your portfolio. It seems to me that cash does absolutely nothing to protect against inflation.

As a by the way, I feel farm ground is over leveraged right now. Near me good to fair ground is ~ 15.000-17.000 per acre. Corporations may be able to survive that, if/when that market fails, but the family farm that is barrowing from the bank to buy now will end up losing the family farm. And that is the plan as I see it. Laid out by the powers that be of course. So for short term cash may be a good parking place. Again just a guess.

3 !!!, the way I’ve seen it, it’s been a shake down since about 1979. When a lot of farmers land, homes, farms, were essentially stolen. So to me, it’s not about one party or the other. They are all the same.The past 3 years have been essentially a shake-down operation.

3 !!!, the way I’ve seen it, it’s been a shake down since about 1979. When a lot of farmers land, homes, farms, were essentially stolen. So to me, it’s not about one party or the other. They are all the same.

No, it's not a political party thing. This is a full blown worldwide religion.

Last edited:

Works for me. “The Powers That Be“ are all about a one world order.No, it's not a olitical party thing. This is a full blown worldwide religion.

Yep, 100% agree. Just didn’t catch your exact point.

Works for me. “The Powers That Be“ are all about a one world order.

Yep, 100% agree. Just didn’t catch your exact point.

It's gained a lot of traction in the past 3 years... always present, but exponential growth.

nonobaddog

Grandmaster

Yeah, thanks, I didn't think their statement about cash was good. I have too much percent in cash now and I was thinking that I am doing something wrong. Cash is losing because of inflation and I really don't know where would be better. I suppose I could get about 5% in CD's or high yield savings but that doesn't seem great.Understood, but all financial planners will suggest keeping some liquidity for “a good deal” if one presents itself. And at this time the paper markets are very volatile. Look at treasury bonds, where banks leverage there money. As I said I was only guessing. Only attempting to answer the question posed. I’m often mistaken. And not a bit afraid to admit it. Best of luck.

CD ladders have been a strategy for a long time. Keeping you in the best of situations for interest capturing and liquidity.Yeah, thanks, I didn't think their statement about cash was good. I have too much percent in cash now and I was thinking that I am doing something wrong. Cash is losing because of inflation and I really don't know where would be better. I suppose I could get about 5% in CD's or high yield savings but that doesn't seem great.

dieselrealtor

Master

As a by the way, I feel farm ground is over leveraged right now. Near me good to fair ground is ~ 15.000-17.000 per acre. Corporations may be able to survive that, if/when that market fails, but the family farm that is barrowing from the bank to buy now will end up losing the family farm. And that is the plan as I see it. Laid out by the powers that be of course. So for short term cash may be a good parking place. Again just a guess.

Real estate is local & there are exceptions to every rule.

With that said, over the past 20+ years I have seen single family residential, mutlifamily residential & commercial go up & down. However farmland has remained stable to increasing, some areas as much as doubling every 7+or- years. Very different animal than other real estate.

When the residential meltdown was recognized in 2008 (started earlier than that) the percentage of bare land foreclosures were miniscule in those numbers.

Staff online

-

d.kaufmanStill Here

Members online

- wagyu52

- AJBB87

- bigretic

- WebSnyper

- d.kaufman

- snorko

- jsharmon7

- Machinist68

- Chase25

- patience0830

- Amishman44

- NyleRN

- yeahbaby

- Dewidmt

- llh1956

- ruger1800

- Lassiter

- Tombs

- BehindBlueI's

- shootersix

- hunterbagwell

- boosteds13cc

- Chalky

- printcraft

- Ltrain37

- Deldorado

- dvd1955

- Wstar425

- ancjr

- wingrider1800

- Libertarian01

- spencer rifle

- Jowl1

- melensdad

- MC1983

- snowwalker

- gassprint1

- Crash7

- DustyMck

- MemphisR32

- chadm

- abc123#*

- joreharr

- Meatstick

- gdun67

- model1994

- Hawkeye7br

- Benza

- Twinks46975

- pokersamurai

Total: 2,069 (members: 235, guests: 1,834)