Alas, 'moral hazard' is only eschewed by those having moralsIt was a big part, the other part is the big money banks knew they could make the profits from the sub-prime loans and the government would back stop the losses just as they did.

Do you believe it was something else?

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Stock Market is ROCKING

- Thread starter Pepi

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Forced.Did they force them too, or did they negotiate them to the position, with all their poor-judgment leadership in place?

Fannie Mae and Freddie Mac forced to buy subprime loans(affordable housing law),and that had a big role in it. They both had government quotas for loans, 30%(raise to 50% by Clinton and then 55% by Bush) had to be at or below median income, that meant if they did not sponsor enough loans they had to buy them,which they did by the millions on the open warket(and thus the MBS is born). By 2002 Fannie Mae and Freddie Mac already had over 1 trillion in subprime loans. By 2007 the two federal agencies had over 70% of sub prime with banks having the other 30%. The whole thing blew up,and it was certainly forced.

Hey, Barney Frank: The Government Did Cause the Housing Crisis

Of the 19.2 million subprime/low quality loans on the books of government agencies in 2008, 12 million were held or guaranteed by Fannie and Freddie

Last edited:

There was a specific law created in 1992. See post above this one.If by force you mean is there a specific law that says make bad loans, there is not that I know of. If by negotiate you mean regs with penalties combined with carrots on the other side, yes, I call that force. My banker friends call that force. And when the leftists told the dems they wanted it they too called it force…

The affordable housing law required Fannie and Freddie to meet government quotas when they bought loans from banks and other mortgage originators,most of those loans were subprime borrowers. It was both sides of the isle though. Bush did not help increasing the quota to 55%.

Combination of multiple things, some carrots, some sticks.

See the Credit Reinvestment Act, particularly changes made during the Clinton Administration.

The one "carrot" was that if you had a "good" CRA score, you could acquire smaller banks and grow. If you didn't, your acquisition would be denied... and you would be shark bait for acquisition.

CRA compliance is part of bank audits... if you didn't have enough low/moderate income mortgages on the books, you we open for DOJ red-lining actions.

The problem is that if you had these loans on your books, they were garbage compared to prime loans, so instead the loans were packaged into loan portfolios, insured by AIG against default, and with that insurance, they rose to "investment grade" portfolios. On your books for CRA scores, but insured by AIG so they didn't wreck the quality of your balance sheet.

Very few, if any, of the big banks made these loans... there wasn't any money in them... instead bought the insured portfolios. Many of the loans in those portfolios were made under "crazy" terms that no reasonable bank would ever make.

Throw in "mark-to-market" on the portfolios rather than the actual delinquency rate (which is what AIG priced their premiums upon) and suddenly AIG had to come up with trillions it did not have... the portfolios would look like IIRC a 75% loss (due to mark-to-market, because nobody wanted them during the crisis, rather than actual defaults... which did go up, but nowhere near the m-2-m losses...).

So, IMO, the cause of the 2008 meltdown was a combination of CRA and mark-to-market on mortgage backed securities... both of which were regulatory regimes.

ETA: At the time, I had a front-row seat for this... I worked at a subprime/consumer finance organization... that was owned by AIG at the time.

See the Credit Reinvestment Act, particularly changes made during the Clinton Administration.

The one "carrot" was that if you had a "good" CRA score, you could acquire smaller banks and grow. If you didn't, your acquisition would be denied... and you would be shark bait for acquisition.

CRA compliance is part of bank audits... if you didn't have enough low/moderate income mortgages on the books, you we open for DOJ red-lining actions.

The problem is that if you had these loans on your books, they were garbage compared to prime loans, so instead the loans were packaged into loan portfolios, insured by AIG against default, and with that insurance, they rose to "investment grade" portfolios. On your books for CRA scores, but insured by AIG so they didn't wreck the quality of your balance sheet.

Very few, if any, of the big banks made these loans... there wasn't any money in them... instead bought the insured portfolios. Many of the loans in those portfolios were made under "crazy" terms that no reasonable bank would ever make.

Throw in "mark-to-market" on the portfolios rather than the actual delinquency rate (which is what AIG priced their premiums upon) and suddenly AIG had to come up with trillions it did not have... the portfolios would look like IIRC a 75% loss (due to mark-to-market, because nobody wanted them during the crisis, rather than actual defaults... which did go up, but nowhere near the m-2-m losses...).

So, IMO, the cause of the 2008 meltdown was a combination of CRA and mark-to-market on mortgage backed securities... both of which were regulatory regimes.

ETA: At the time, I had a front-row seat for this... I worked at a subprime/consumer finance organization... that was owned by AIG at the time.

Well stated, knew you had a front row seat before you told us…Combination of multiple things, some carrots, some sticks.

See the Credit Reinvestment Act, particularly changes made during the Clinton Administration.

The one "carrot" was that if you had a "good" CRA score, you could acquire smaller banks and grow. If you didn't, your acquisition would be denied... and you would be shark bait for acquisition.

CRA compliance is part of bank audits... if you didn't have enough low/moderate income mortgages on the books, you we open for DOJ red-lining actions.

The problem is that if you had these loans on your books, they were garbage compared to prime loans, so instead the loans were packaged into loan portfolios, insured by AIG against default, and with that insurance, they rose to "investment grade" portfolios. On your books for CRA scores, but insured by AIG so they didn't wreck the quality of your balance sheet.

Very few, if any, of the big banks made these loans... there wasn't any money in them... instead bought the insured portfolios. Many of the loans in those portfolios were made under "crazy" terms that no reasonable bank would ever make.

Throw in "mark-to-market" on the portfolios rather than the actual delinquency rate (which is what AIG priced their premiums upon) and suddenly AIG had to come up with trillions it did not have... the portfolios would look like IIRC a 75% loss (due to mark-to-market, because nobody wanted them during the crisis, rather than actual defaults... which did go up, but nowhere near the m-2-m losses...).

So, IMO, the cause of the 2008 meltdown was a combination of CRA and mark-to-market on mortgage backed securities... both of which were regulatory regimes.

ETA: At the time, I had a front-row seat for this... I worked at a subprime/consumer finance organization... that was owned by AIG at the time.

First Republic stock listed as junk. US officials are exploring the possibility of government backing to encourage a deal that would shore up the lender, people with knowledge of the situation said.(after JP went hands off on the now firesale.

www.zerohedge.com

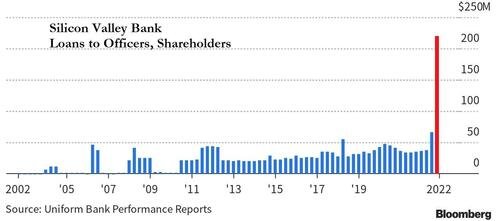

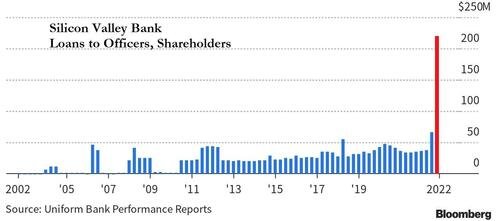

Execs and top shareholders recieved loans of over 200 million

www.zerohedge.com

Execs and top shareholders recieved loans of over 200 million

shortly before it collapsed, from Silicone Valley bank.

www.zerohedge.com

www.zerohedge.com

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

shortly before it collapsed, from Silicone Valley bank.

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Aren’t we surprised that JPM went hands off?First Republic stock listed as junk. US officials are exploring the possibility of government backing to encourage a deal that would shore up the lender, people with knowledge of the situation said.(after JP went hands off on the now firesale.

Execs and top shareholders recieved loans of over 200 millionZerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

shortly before it collapsed, from Silicone Valley bank.

View attachment 264573

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Not when they wanted a sweeter government backed deal,no.Aren’t we surprised that JPM went hands off?

morga...fights sneeze... n stanley.

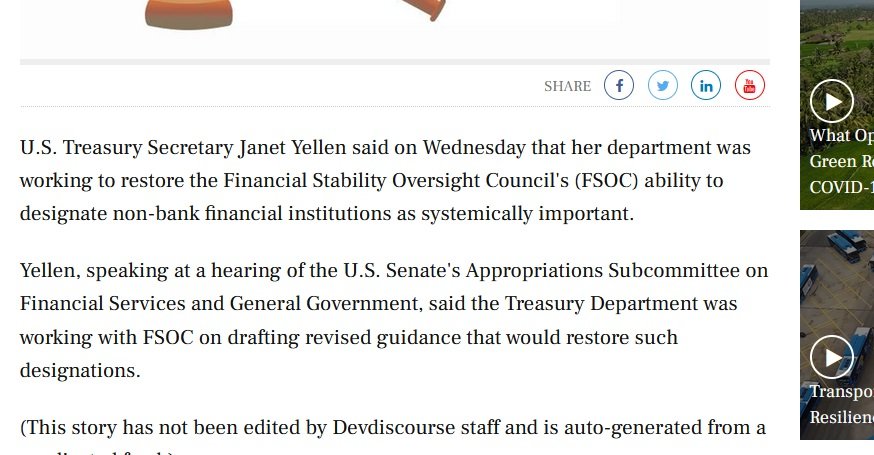

Well. That was interesting. See they changed the title of the article as well as the contents of said article after I had copied the link. The link I wanted to post is in the image below. Guess us peasants can not see that information. In short they are planning on the US Treasury bailing out investment firms(systemic would mean 100% backing of any losses) and hedge funds(just needs to be democrat run and pass a vote ala SVB),something that did not happen even in 2008.

Found a source for the first two paragraphs. Sadly wayback does not have the article(doubt it was up long enough).

First two paragraphs of the original article.

"U.S. Treasury Secretary Janet Yellen said on Wednesday that her department was working to restore the Financial Stability Oversight Council's (FSOC) ability to designate non-bank financial institutions as systemically important.

Yellen, speaking at a hearing of the U.S. Senate's Appropriations Subcommittee on Financial Services and General Government, said the Treasury Department was working with FSOC on drafting revised guidance that would restore such designations."

This is below it at the link.

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

www.devdiscourse.com

www.devdiscourse.com

The rest is lost in the ether apparently.

Ok,******** I still have the page up...that it NOT the story I am looking at. Screenshot incoming. They really do not want this out there.

Yellen says not considering 'blanket insurance' for all U.S. bank deposits By Reuters

Yellen says not considering 'blanket insurance' for all U.S. bank deposits

www.investing.com

Well. That was interesting. See they changed the title of the article as well as the contents of said article after I had copied the link. The link I wanted to post is in the image below. Guess us peasants can not see that information. In short they are planning on the US Treasury bailing out investment firms(systemic would mean 100% backing of any losses) and hedge funds(just needs to be democrat run and pass a vote ala SVB),something that did not happen even in 2008.

Found a source for the first two paragraphs. Sadly wayback does not have the article(doubt it was up long enough).

First two paragraphs of the original article.

"U.S. Treasury Secretary Janet Yellen said on Wednesday that her department was working to restore the Financial Stability Oversight Council's (FSOC) ability to designate non-bank financial institutions as systemically important.

Yellen, speaking at a hearing of the U.S. Senate's Appropriations Subcommittee on Financial Services and General Government, said the Treasury Department was working with FSOC on drafting revised guidance that would restore such designations."

This is below it at the link.

(This story has not been edited by Devdiscourse staff and is auto-generated from a syndicated feed.)

Denver school shooting leaves two staffers wounded, suspect at large | Education

Police and school officials did not identify the suspect. "This particular student had a safety plan that was in place where they were to be searched at the beginning of the school day every day," Thomas said While the staffers, both of them male, were conducting that search, several shots were...

The rest is lost in the ether apparently.

Ok,******** I still have the page up...that it NOT the story I am looking at. Screenshot incoming. They really do not want this out there.

Last edited:

This would restart the panic

UBS set for talks with Michael Klein to terminate Credit Suisse investment bank deal - FT

UBS on Sunday agreed to buy rival Swiss bank Credit Suisse for 3 billion Swiss francs ($3.23 billion) in stock and agreed to assume up to 5 billion francs ($5.4 billion) in losses, in a shotgun merger engineered by Swiss authorities to avoid more market-shaking turmoil in global banking. Klein...

It never stopped. Derivatives and balance sheets have not changed. It looks like UBS will back out for sure. Then what for the shareholders who got paid and AT-1 investors that lost 17+ billion?

They are acting calm in public,but warning insiders and feaking out behind the scenes.

Just the video of the meeting of SVB's bailout(Treasury,Fed,and FDIC people) should have made that clear with the FDIC commenting "Well at least the public will believe the banks are sound",because everyone in that room knew they were not. I will look for a link to that video. I saw it on twitter at one point,but that entire account is now gone.

I think your read on that article is incorrect.

UBS set for talks with Michael Klein to terminate Credit Suisse investment bank deal - FT

UBS on Sunday agreed to buy rival Swiss bank Credit Suisse for 3 billion Swiss francs ($3.23 billion) in stock and agreed to assume up to 5 billion francs ($5.4 billion) in losses, in a shotgun merger engineered by Swiss authorities to avoid more market-shaking turmoil in global banking. Klein...www.yahoo.com

It never stopped. Derivatives and balance sheets have not changed. It looks like UBS will back out for sure. Then what for the shareholders who got paid and AT-1 investors that lost 17+ billion?

I love The Onion.This is more insane than keynesian economics.

Zerohedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

Sure wish this was one of their stories...

I love The Onion.

Sure wish this was one of their stories...

US Studies Ways to Insure All Bank Deposits If Crisis Grows

(Bloomberg) -- US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.Most Read from BloombergBomb Threat Called In to New York...

Yea. Not an onion story. Zerohedge was just the first to report it.

Would have been funny if it was an Onion story.

US Studies Ways to Insure All Bank Deposits If Crisis Grows

(Bloomberg) -- US officials are studying ways they might temporarily expand Federal Deposit Insurance Corp. coverage to all deposits, a move sought by a coalition of banks arguing that it’s needed to head off a potential financial crisis.Most Read from BloombergBomb Threat Called In to New York...news.yahoo.com

Yea. Not an onion story. Zerohedge was just the first to report it.

As it is, it's just sad, and infuriating.

If UBS loses in canceling the deal with Klein,then it purchased air and Klein walks away with most of the assets of CS. Not sure what you mean by incorrect?I think your read on that article is incorrect.

Found the video. All of it.

UBS set for talks with Michael Klein to terminate Credit Suisse investment bank deal - FT

UBS on Sunday agreed to buy rival Swiss bank Credit Suisse for 3 billion Swiss francs ($3.23 billion) in stock and agreed to assume up to 5 billion francs ($5.4 billion) in losses, in a shotgun merger engineered by Swiss authorities to avoid more market-shaking turmoil in global banking. Klein...www.yahoo.com

It never stopped. Derivatives and balance sheets have not changed. It looks like UBS will back out for sure. Then what for the shareholders who got paid and AT-1 investors that lost 17+ billion?

They are acting calm in public,but warning insiders and feaking out behind the scenes.

Just the video of the meeting of SVB's bailout(Treasury,Fed,and FDIC people) should have made that clear with the FDIC commenting "Well at least the public will believe the banks are sound",because everyone in that room knew they were not. I will look for a link to that video. I saw it on twitter at one point,but that entire account is now gone.

Last edited:

The Klien deal was to convert US based CS customers to CS First Boston, not the whole thing. That was like a $175mil deal with CS buying the Klien group.If UBS loses in canceling the deal with Klein,then it purchased air and Klein walks away with most of the assets of CS. Not sure what you mean by incorrect?

Klien was never going to get UBS it's the other way around. They wanna fire him and cancel the purchase.

Might want to download and read. It may have been a 175mil deal,but the assets it manages are worth far more. After the collapse it is likely one of the most valuable parts of CS. Last report posted it alone paid 2519284 in THOUSANDS just in taxes(link below). 4302 line 9.The Klien deal was to convert US based CS customers to CS First Boston, not the whole thing. That was like a $175mil deal with CS buying the Klien group.

Klien was never going to get UBS it's the other way around. They wanna fire him and cancel the purchase.

Credit Suisse Holdings (USA), Inc.

Interim and annual reports of Credit Suisse Holdings (USA), Inc., a wholly owned subsidiary of Credit Suisse AG, in turn a subsidiary of Credit Suisse Group AG.

Last edited: