The second anchor (of many) that keeps physical traders from making a buck. Who can keep up with a computer?I think the velocity of the paper is more concerning that the quantity...

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Is Silver next?

- Thread starter Magyars

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

spencer rifle

Grandmaster

So, what's with all the flat lines for PMs this morning?

Something's up with Kitco. It hasn't updated since 8 a.m.. Gold has been going up according to Monument.So, what's with all the flat lines for PMs this morning?

I thought this morning would be interesting, keep a weather eye on your FRN’s. (they’re dropping) oil is climbing. Not being a chicken little but this could be “the big one”. I hope not, but I’m not taking my eyes off the dollar. It’s only 8 minutes from my house to our local Farmers Bank, a small town privately owned 3 branch bank.

8 minutes and some paper work, while on the phone to my broker to lock up metal price. I’m good to go. Back home to get at least one shotgun rider. 1 hr. Into city, 1 hr. home. Call wife, get her headed this way. I’m done. See you guys on the other side.

G****** Powell, and his big mouth. Stupid S** ** * *****. Raise rates, made the announcement Friday just before closing bell. What did he think would happen? It’s almost like they (the FED) want to cause a panic. What are these people thinking? G** **** dombocrats, G** **** Federal Res.

8 minutes and some paper work, while on the phone to my broker to lock up metal price. I’m good to go. Back home to get at least one shotgun rider. 1 hr. Into city, 1 hr. home. Call wife, get her headed this way. I’m done. See you guys on the other side.

G****** Powell, and his big mouth. Stupid S** ** * *****. Raise rates, made the announcement Friday just before closing bell. What did he think would happen? It’s almost like they (the FED) want to cause a panic. What are these people thinking? G** **** dombocrats, G** **** Federal Res.

Just listened to this podcast a couple days ago. Seemed like an informative and balanced perspective. Big takeaways:

- Gold is leaving vaults at a high rate despite a fairly flat price

- Inevitable does not mean imminent.

You're welcome.

Now your talkin, and at almost 95:1 a good chance for some to move some gold to silver if you can remain diversified.Just ordered 2 oz. gold from Monument. DoggyMama wanted a gold eagle and I ordered one of these for $70.00 less than her eagle.

View attachment 221001

Dollar is down again after a small rise. Oil down, DJIA also down.

Good show DD. It’s better than FRN’s in the bank.

I'm trying to get more gold. I mostly have silver. Just received the first of two 10 oz. Unity & Liberty bars today that I had ordered from Monument in the past couple of weeks.Now your talkin, and at almost 95:1 a good chance for some to move some gold to silver if you can remain diversified.

Dollar is down again after a small rise. Oil down, DJIA also down.

Good show DD. It’s better than FRN’s in the bank.

Yep, as in all things investing diversification is a key. I’m starting to investigate copper. I’ve got a couple of 1 oz. Rounds that I’ve picked up over the years, more as happenstance than anything else. But I’m now seriously looking at a couple 100 or even 10 oz. bullion bars. If I had it to do over again copper was the smart move 50 years ago. Easy to say that now, reading the past is sure easier than reading the future.I'm trying to get more gold. I mostly have silver. Just received the first of two 10 oz. Unity & Liberty bars today that I had ordered from Monument in the past couple of weeks.

View attachment 221058

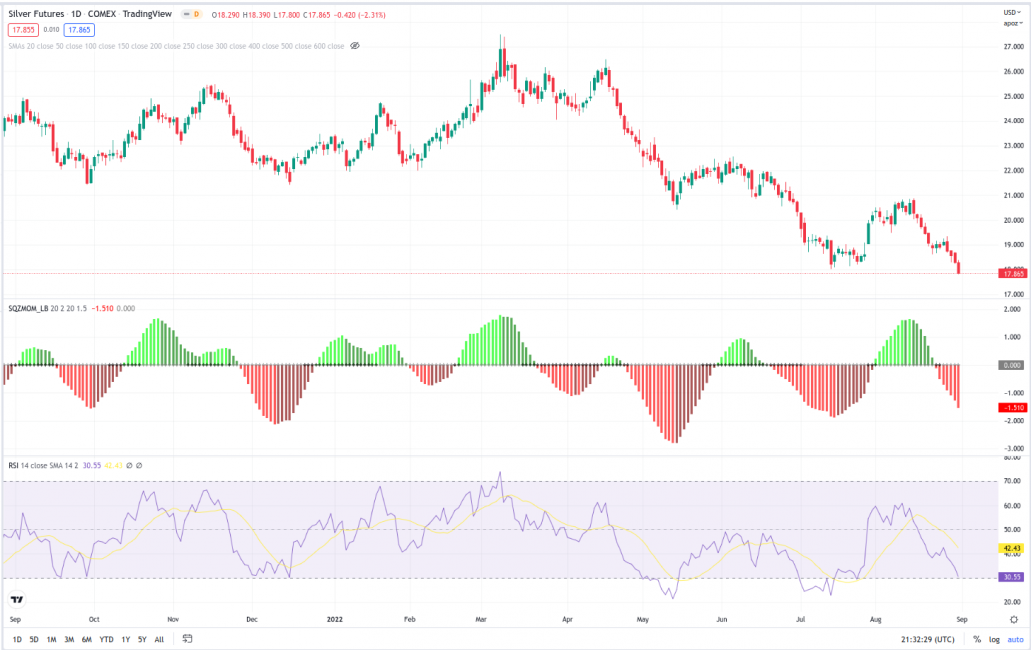

The spot dropping today is killing me. I just paid my Q3 quarterly taxes and am actually taking some vacation soon and want to splurge some cash on that. So the extra money fund is low when silver looks to close in on $18/oz.

Yep, it even dipped below 18 for a bit today. 17.98 as I type this.The spot dropping today is killing me. I just paid my Q3 quarterly taxes and am actually taking some vacation soon and want to splurge some cash on that. So the extra money fund is low when silver looks to close in on $18/oz.

10oz bar $207.94 as I type https://silvergoldbull.com/wss-10-oz-our-choice-of-new-silvertowne-silver-bar

That's a good deal! I don't know if they charge tax or not, but at least shipping would be free.10oz bar $207.94 as I type https://silvergoldbull.com/wss-10-oz-our-choice-of-new-silvertowne-silver-bar

That's a good deal! I don't know if they charge tax or not, but at least shipping would be free.

I'm waiting to see what tomorrow and Friday does...

Staff online

-

Cameramonkeywww.thechosen.tv

Members online

- doddg

- crookcountygo

- indyartisan

- cedarhillfarms11

- kasamp

- Bennettjh

- Creedmoor

- Born2vette

- duanewade

- ISO400

- mondoreli

- Timjoebillybob

- Andyccw

- Cameramonkey

- AEAMMO.COM

- nhgluff

- Colt556

- TacOpsGuy320

- mike trible

- Gandalf

- XDdreams

- printcraft

- Kirk Freeman

- shibumiseeker

- Irish354

- Chewie

- cobber

- Wolfhound

- Nacho Man

- mcapo

- rmw250

- Brandon

- MarylandTacomaRider

- Myrradah

- slims2002

- cmann250

- rbhargan

- Crash7

- semperfi211

- Tradesylver

- BeDome

- mike45

- jim b

- Rick Mason

- BigMoose

- phylodog

- TheGrumpyGuy

- ACR

- Mgderf

- jagee

Total: 1,722 (members: 224, guests: 1,498)