These are two different programs. The public service loan forgiveness program has been around for about a decade and a half already and it's been an absolute disaster. The percentage of public service loans that have actually been forgiven is around 2-3%.View attachment 221816

Daughters were all excited that $10k of their collage debt was going to be forgiven. Then they read the fine print. No debt forgiveness until 10 years of payments have been made.

FACT SHEET: President Biden Announces Student Loan Relief for Borrowers Who Need It Most | The White House

A three-part plan delivers on President Biden’s promise to cancel $10,000 of student debt for low- to middle-income borrowers President Biden believes that a post-high school education should be a ticket to a middle-class life, but for too many, the cost of borrowing for college is a lifelong...www.whitehouse.gov

New Data Shows Most Who Apply To This Student Loan Forgiveness Program Are Denied

The data shows that 98% of applications for Public Service Loan Forgiveness (PSLF) were rejected. Will the Biden administration take steps to fix the broken program?

www.forbes.com

www.forbes.com

I don't know why anyone would want to wallow around in debt for ten years waiting for a government program with a 2-3% success rate.

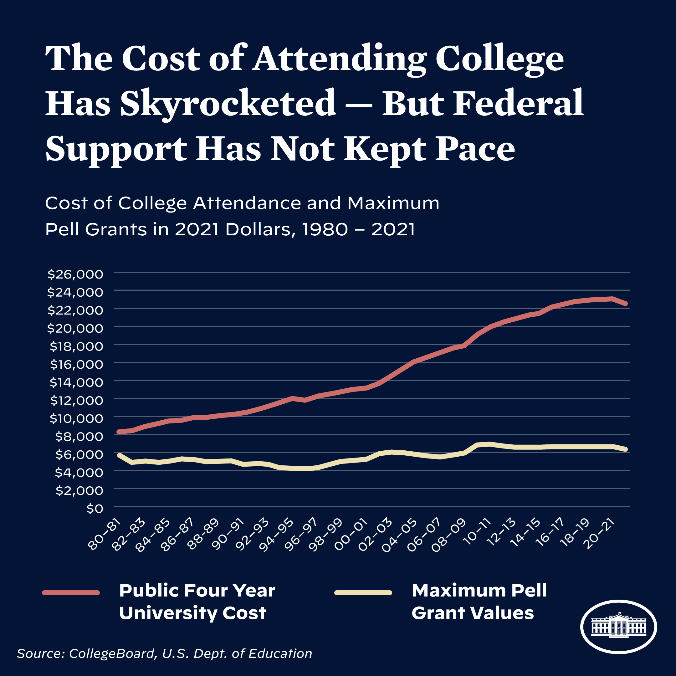

And then there is the idea of lowering payments based on income. How is that helpful for a low income earners? All it does is draw out the term of the loan indefinitely, while never actually touching the principal. It essentially ensures people will be paying student loans their entire lives.

"The rich rule over the poor, and the borrower is slave to the lender." - Proverbs 22:7

about adding to the Federal debt.

about adding to the Federal debt.