First reading, it doesn’t sound like a horrible idea.

Still feel like it’s more about control and wealth redistribution.

www.yahoo.com

www.yahoo.com

Still feel like it’s more about control and wealth redistribution.

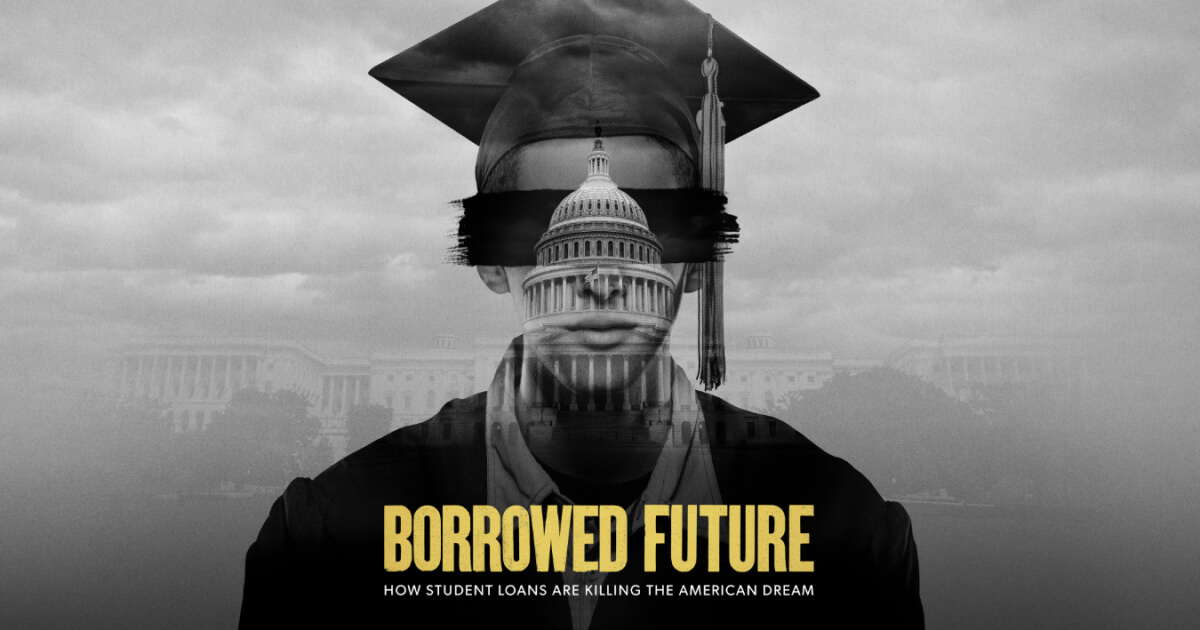

New law links your student loans with retirement savings

Tucked inside the $1.7 trillion government spending bill are a series of provisions that experts say is nothing short of a redefinition of what makes up the retirement system itself.

)

)