-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Second Largest Bank Failure in U.S. History…

- Thread starter Ingomike

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Even though not just woke companies/investors will get screwed? There are conservative companies that just happened to use that bank too for their banking needs.I really hope the do not bail out this woke wreck.

This is excellent advice. If you can do it, you should. There is a good book called becoming your own banker by Nelson Nash. Its a cool concept.Look at when and how much the ceo and insiders sold their stocks.

They got theirs.

Be your own bank.

DragonGunner

Grandmaster

Saw on news people are covered up to $250,000 but also said 80% will never recover all their money. Also several years ago our Congress passed something to the degree the banks can do anything and Congress can’t do anything. So a bank folds they literally can take your house and car,,, anything you have a loan on. How could they do this. Because they actually own it until you have paid it off. So they can legally take it away from you and sell it to recupe losses. How can they do this. Because Congress passed it.

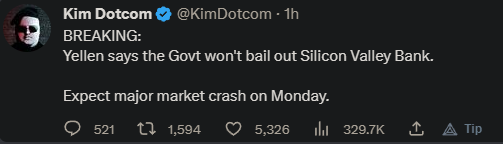

Yellen Says Government Will Help SVB Depositors But "No Bailout" As Fed, FDIC "Hope" Talk Of Special Vehicle Prevents More Bank Runs | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Well, needless to say, any time one mentions "hope" as a wise macroprudential policy, alarms go off, because the entire banking system suddenly becomes reduced to a game of chicken as follows: Fed/regulators won't backstop deposits today and won't admit a bank crisis is emerging, but if a bank crisis emerges and there is a flight of deposits on Monday morning, they will move.

Did you prepare?

She's another wokester, and hasn't been right since obiden became resident.....get your money out of the banks and convert it into something other than fiat.

apnews.com

apnews.com

US government moves to stop potential banking crisis

The U.S. government took extraordinary steps Sunday to stop a potential banking crisis after the historic failure of Silicon Valley Bank, assuring depositors at the failed financial institution that they would be able to access all of their money quickly.

I do not care who used that bank. No bailout. Why should taxpayers pay because someone had more than 250k in one bank? Especially given that banks policies of DEI and CRT above share holders,depositors,and employee well being. It is not as if there where no warnings. People started pulling out deposits in quarter 4 (33 billion of them according to Q4 report).Even though not just woke companies/investors will get screwed? There are conservative companies that just happened to use that bank too for their banking needs.

If you where using that bank you had to know this. A simple look at their page and DEI quarterly reports(yes in addition to normal quarterly reports) would have made it clear. If you had uninsured funds over 250k you certainly should have been reading quarterly reports.

Learn to make better choices. Hard lesson,but it needs learned. It is illegal to bail them out with the treasury or fed after frank dodd. It would take an executive order(that would be illegal) or an act of congress.

You made bad choices. It is that simple.

Only 7% of the money in SVB was standard deposits. Most of the money was VC money. It was leveraged and used to invest in start ups. Some of those failed to. That extra .6% of interest was what you were paid for the risk. Investing is not without risk.

The 80 billion purchase of MBS(with leverage) at a time rates were rising should have set off every alarm bell,but did not because "equity" and that being more important to the risk managers of the bank. No sane risk manager would have approved(The head of risk management did quit last year after that and was not replaced until January of this year). Know who you are banking with.

Our entire financial system is at risk of failing. Debt and how it is created is the problem. It has lasted longer than I though it could or should. Something I have been mocked for pointing out.

There are far larger problems than SVB. I still believe most US banks are insolvent(2.2 trillion every night in fed Repo window lending is a clue).

Since this post of mine almost exactly 3 years they increased reserve requirements to 4.5% and increased overnight lending at the Repo window from 500 billion to 2.2 trillion. If you do not see the problems you choose not to. Choosing a bank that ignores reality(buying MBS with leverage while rates rise) is not something one should ignore.

I bank with Chase. The reason is simple. If it fails with 3.3 trillion in assets it means the dollar has collapsed,and what bank you use would not matter. I keep enough funds in the bank to pay bills that is all. I try to live fairly debt free with a few credit cards active,but paid off monthly. I have physical wealth I can hold in my hand in gold and silver. We are coming to the end of an era. Things will change because they have to.

Coronavirus

Doctor shows how to use one ventilator for 4 patients.May want to show this to medical staff. I have already sent this to the hospital nearest me. They have a facebook,and many have twitter as well. Get this video to the people that should understand it before they need it...

I am not the only one who is seeing and has seen the problem since 2008.

The Collapse Of SVB Portends Real Dangers | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Last edited:

I call BS. Its not always that cut and dried. I am paid by a company using a vendor that uses(d) that bank. Neither my wife nor I got a paycheck Friday because of it. I'm blessed its only for side gigs that goes straight into savings. We had no way of knowing who they bank with. Am I supposed to ask my employer to ask the payroll company who they use for a bank so it doesnt happen again from now on?I do not care who used that bank. No bailout. Why should taxpayers pay because someone had more than 250k in one bank? Especially given that banks policies of DEI and CRT above share holders,depositors,and employee well being. It is not as if there where no warnings. People started pulling out deposits in quarter 4 (33 billion of them according to Q4 report).

If you where using that bank you had to know this. A simple look at their page and DEI quarterly reports(yes in addition to normal

And if you think I need to ask every last vendor what bank they use, you are crazy.

True. You likely would never know who the payroll company used unless it was listed on your deposits. Even if it was though you did not get to make the choice. I would wager you do understand the institution you deposited into though.I call BS. Its not always that cut and dried. I am paid by a company using a vendor that uses(d) that bank. Neither my wife nor I got a paycheck Friday because of it. I'm blessed its only for side gigs that goes straight into savings. We had no way of knowing who they bank with. Am I supposed to ask my employer to ask the payroll company who they use for a bank so it doesnt happen again from now on?

And if you think I need to ask every last vendor what bank they use, you are crazy.

In your case it would be your employer who should have known.

Last edited:

I call BS. Its not always that cut and dried. I am paid by a company using a vendor that uses(d) that bank. Neither my wife nor I got a paycheck Friday because of it. I'm blessed its only for side gigs that goes straight into savings. We had no way of knowing who they bank with. Am I supposed to ask my employer to ask the payroll company who they use for a bank so it doesnt happen again from now on?

And if you think I need to ask every last vendor what bank they use, you are crazy.

I'm curious how long people like yourself will work for a business that has these payroll problems before deciding to stay home?

Some of this is mathematical semantics; the news is stating that 80% number, making people think that someone with 250k in the bank won’t get their money back. Now granted, that could happen, but that’s a much bigger collapse that hasn’t happened *yet*.Saw on news people are covered up to $250,000 but also said 80% will never recover all their money. Also several years ago our Congress passed something to the degree the banks can do anything and Congress can’t do anything. So a bank folds they literally can take your house and car,,, anything you have a loan on. How could they do this. Because they actually own it until you have paid it off. So they can legally take it away from you and sell it to recupe losses. How can they do this. Because Congress passed it.

What they’re not explaining is that 80% number refers to the people (ok institutions mostly) that have say, $1,250,000 in the bank and they’re going to get 250,000 back, therefore “losing 80%”. The reality is that there are depositors with many millions in the bank, and they’ll probably get 250k back, from the fdic insurance perspective.

If Joe average has 250k in the bank, the way things are working now, he’s insured.

That being said, my grandmothers family had “all their money” in the bank at Rosston in the 30’s, the bank folded and the money she was going to use to attend Purdue was gone. She still found a way to go that fall as scheduled, not sure how.

Smarts, perseverance, grit will separate those with a will to thrive in hard times.

No. My wife is the financial secretary who handles that stuff. There was no indication. The drafts outbound showed our payroll company name, not the actual bank name.True. You likely would never know who the payroll company used unless it was listed on your deposits. Even if it was though you did not get to make the choice. I would wager you do understand the institution you deposited into though.

In your case it would be your employer who should have known.

So I guess we all need to check the routing numbers on all of our EBTs and look up the actual instututions, then google those banks, investigate their policies, Monitor fed policy and any alerts regarding them, etc?

Give me a flippin break. Some of y'all are blindly black and white with no grasp on how ridiculous this sounds. Direct interactions, sure. If I bank with PNC I should be aware of what they are doing. But to claim somebody should be playing six degrees of wokeness with their various vendors is absolute ridiculousness.

Good point. But we are lucky. We are expected to have our money by COB Monday. And if not our org will cut checks to those who need them and sort it all out later when the dust settles.I'm curious how long people like yourself will work for a business that has these payroll problems before deciding to stay home?

Good point. But we are lucky. We are expected to have our money by COB Monday. And if not our org will cut checks to those who need them and sort it all out later when the dust settles.

Thanks, I was curious as where I used to work the company used ADP and I really never gave it a second thought. I would imagine any organization with a payroll to meet would have to react quickly in the event those checks didn't arrive or worse, bounced.

Not long I bet. People got real used to staying home for covid, and they’ll have no good will to work for an employer that won’t pay.I'm curious how long people like yourself will work for a business that has these payroll problems before deciding to stay home?

There won’t be any safety net, or at least not as much of one this time is it goes south, though.

It’s almost past time to network to survive.

I have a side gig that uses them as well. We are also hoping for Monday, but news over the weekend has not been cheery.Apparently Patriot Software uses them for banking. (its a small-ish accounting/payroll company)

I didnt get paid for my side gig yesterday because of this. Luckily for all but one of us this is a side gig, and the one has plenty of cushion to last until Monday when they expect to be able to direct deposit our checks into our bank accounts.

So the money they drafted in last week to pay our payroll is tied up in this mess. Because of the takeover, our funds were locked and unable to transfer out before the FDIC took over and halted everything.

If you are using a 3rd party for payroll you should know about the company you choose to use,and should certainly understand who that company chooses to route your payroll through.No. My wife is the financial secretary who handles that stuff. There was no indication. The drafts outbound showed our payroll company name, not the actual bank name.

So I guess we all need to check the routing numbers on all of our EBTs and look up the actual instututions, then google those banks, investigate their policies, Monitor fed policy and any alerts regarding them, etc?

Give me a flippin break. Some of y'all are blindly black and white with no grasp on how ridiculous this sounds. Direct interactions, sure. If I bank with PNC I should be aware of what they are doing. But to claim somebody should be playing six degrees of wokeness with their various vendors is absolute ridiculousness.

When I was a broker and co owner of the company I certainly knew who I was using to pay our contractors(lawncare,FHA rehab,trashouts ect) and agents. We did not handle our own payroll.

We used a program 5/3rd bank had at the time,once we became to large to handle payroll on our own. In mid 2008 we had 297 Mibor listings,not a huge company but not small either.

How could you not understand who the company you run payroll through is? Or rather why would you not?

I do not understand your point apparently. To me who I hired to handle paying our people if we were not running payroll anymore was an important decision, that we looked into for more than a month to find a choice that fit.

Last edited:

Considering banks typically dont go under very often, it wasnt even on our radar. We understood the company we used. We didnt realize we needed to scrutinize every last vendor our vendor used, what vendors our vendor's vendors use, etc. Once again, the six degrees.How could you not understand who the company you run payroll through is? Or rather why would you not?

I do not understand your point apparently. To me who I hired to handle paying our people if we were not running payroll anymore was an important decision, that we looked into for more than a month to find a choice that fit.

Maybe I am just to old school,but what part involves anything but your payroll company and who they bank with? It is you,your employees(contractors),and who payroll is run through(and what financial institution do they use)?Considering banks typically dont go under very often, it wasnt even on our radar. We understood the company we used. We didnt realize we needed to scrutinize every last vendor our vendor used, what vendors our vendor's vendors use, etc. Once again, the six degrees.

I do not see what other vendors have to do with anything? Unless your payroll company was outsourcing your actual payroll to another company, then in that case I would not use them.

Staff online

-

d.kaufmanStill Here

-

mom45Momerator

-

Cameramonkeywww.thechosen.tv

Members online

- Poddy

- mmpsteve

- medavis428@

- Businessend

- Glocker99

- Texas21

- pitbulld45

- SEIndSAM

- ditcherman

- Tomahawkman

- mcapo

- Huntinghabit

- Iurobz

- Wstar425

- hoosier88

- ChooterMcGavin1973

- maceace

- gassprint1

- led4thehed2

- HD1

- tsm

- d.kaufman

- darkkevin

- Lassiter

- 2500chev

- crookcountygo

- Glocktard

- drm-hp

- 9teen56f100

- Sigblitz

- BigBoxaJunk

- C4-621

- Wfulton

- Blacknight179

- Gabriel

- mom45

- BehindBlueI's

- Nolecash

- pokersamurai

- Basher

- ckcollins2003

- iauffenberg

- Glock Fan

- gcoop

- Vimace

- Cameramonkey

- Ole'Plinkster

- knutty

- T4rdV4rk

- randomrambo

Total: 2,409 (members: 74, guests: 2,335)