-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Today's You Can't Make This Sh*t Up News

- Thread starter JCSR

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

My guess would be they go after homes owned by corporations. 40+% now are not owner occupied. It would be the leftist thing to do(not that I agree with buying up entire neighbourhood's to raise prices, and then leaving them empty).

Hedge Fund Gobbles Up Hundreds of Residential Homes in a Day for $98M

It's troubling that Wall Street is increasingly in control of Main Street properties in various places across America.

www.westernjournal.com

www.westernjournal.com

In 2 years the tenants will have torn up the houses and the corporate owners have no interest in spending money on continuous repairs that rentals need. Tenants stop paying and wait for the courts to evict them (free housing for 6-18 months). The corporations spend on legal fees and repairs without money coming in, the securities become worthless.

223 Gunner

Master

Exactly. And some families that would love to live in and maintain a home cannot afford them.In 2 years the tenants will have torn up the houses and the corporate owners have no interest in spending money on continuous repairs that rentals need. Tenants stop paying and wait for the courts to evict them (free housing for 6-18 months). The corporations spend on legal fees and repairs without money coming in, the securities become worthless.

Of course, let's forget about the health problems.

If you eat someone wouldn't you then get all their health problems? Of course the young healthy ones will be the hardest to catch. Do you take a chance on an old fat slow person? Damn more decisions..................Of course, let's forget about the health problems.

Maybe I'll be safe for a while.If you eat someone wouldn't you then get all their health problems? Of course the young healthy ones will be the hardest to catch. Do you take a chance on an old fat slow person? Damn more decisions..................

Over eating has it's advantages!Maybe I'll be safe for a while.

Eat the bugs and the people. I’ve had enough of these types of morons. We are reaching a point where things have to break.

Well, it looks like the risk is in eating the brain

www.medicalnewstoday.com

www.medicalnewstoday.com

Cannibalism: A health warning

For many reasons, cannibalism is unanimously frowned upon in the Western world. But, aside from the ethics, is eating human flesh bad for your health?

www.medicalnewstoday.com

www.medicalnewstoday.com

What tenants? Many of these funds are leaving most the homes empty. It is not about them earning an income from them, it is about raising the price and rents for other homes and properties they own, mostly multi unit housing as it is easier to manage. It is about total control of areas.In 2 years the tenants will have torn up the houses and the corporate owners have no interest in spending money on continuous repairs that rentals need. Tenants stop paying and wait for the courts to evict them (free housing for 6-18 months). The corporations spend on legal fees and repairs without money coming in, the securities become worthless.

Hedge Fund Gobbles Up Hundreds of Residential Homes in a Day for $98M

It's troubling that Wall Street is increasingly in control of Main Street properties in various places across America.www.westernjournal.com

Sound investment if you are connected to the government, they pay well for housing illegals and they never have to wait on the rent.

The article says they are using rental income as collateral for securities they plan to sell. Taking houses out of the inventory in a large enough stock to affect the rental and sales markets would require Yuge investment.What tenants? Many of these funds are leaving most the homes empty. It is not about them earning an income from them, it is about raising the price and rents for other homes and properties they own, mostly multi unit housing as it is easier to manage. It is about total control of areas.

Leaving houses empty in Vegas is asking for squatters and scavengers to ruin the homes conditions before the investors can turn the market. Sounds risky but I guess thats why they're doing it in Vegas

They already own 26% of the entire US market,and in many metro areas over 40%.The article says they are using rental income as collateral for securities they plan to sell. Taking houses out of the inventory in a large enough stock to affect the rental and sales markets would require Yuge investment.

Leaving houses empty in Vegas is asking for squatters and scavengers to ruin the homes conditions before the investors can turn the market. Sounds risky but I guess thats why they're doing it in Vegas

Share of Investor-Owned U.S. Homes Remains High in 2023

The sizable U.S. home investor share of ownership seen over the past two years held steady going into the summer of 2023. In March 2023, investors accounted for 27% of all single-family home purchases; by June, that number was almost unchanged at 26%.

www.worldpropertyjournal.com

Loading…

www.washingtonpost.com

I have had over 190 listings at once before(in Indiana) and understand the real estate market fairly well. They leave many of the homes empty, they simply become write offs. It depends on what they want their book to show that year. Same for selling them at a loss or transferring them to other companies(they likely own) for profit or loss ect. It has been getting much much more prominent since 2008. If a fund sets their sights on a metro area for example, they first find who already owns 20+% ,and make deals with them first.

It is a big game to them, all about extracting wealth (MBS are back in fashion as well, but good luck ever actually figuring out who owns what, as that market is fractional ownerships and total chaos).

My primary client base were institutional, not home owners from 2006-2015.

We are not talking small investors who have 1-20 homes. We are talking hedge funds and REITs that own millions of properties and billions invested. Some huge firms like Blackrock have divisions that will buy up entire zip codes. Largest deal I ever did was 26 homes at once, all in one zip code(46060). Every property was already owned by institutions as well, I just happen to have those listings. They purchased from other brokers as well who had listings in the zip they wanted to control.

I mostly left the business in 2012, after moving out of state for awhile. It is not something I really want to participate in anymore, and don't.

Last edited:

Thanks for taking the time to give me the background. I've heard of plan but didn't realize how far it had been developed.They already own 26% of the entire US market,and in many metro areas over 40%.

Share of Investor-Owned U.S. Homes Remains High in 2023

The sizable U.S. home investor share of ownership seen over the past two years held steady going into the summer of 2023. In March 2023, investors accounted for 27% of all single-family home purchases; by June, that number was almost unchanged at 26%.www.worldpropertyjournal.com

Loading…

www.washingtonpost.com

I have had over 190 listings at once before(in Indiana) and understand the real estate market fairly well. They leave many of the homes empty, they simply become write offs. It depends on what they want their book to show that year. Same for selling them at a loss or transferring them to other companies(they likely own) for profit or loss ect. It has been getting much much more prominent since 2008. If a fund sets their sights on a metro area for example, they first find who already owns 20+% ,and make deals with them first.

It is a big game to them, all about extracting wealth (MBS are back in fashion as well, but good luck ever actually figuring out who owns what, as that market is fractional ownerships and total chaos).

My primary client base were institutional, not home owners from 2006-2015.

We are not talking small investors who have 1-20 homes. We are talking hedge funds and REITs that own millions of properties and billions invested. Some huge firms like Blackrock have divisions that will buy up entire zip codes. Largest deal I ever did was 26 homes at once, all in one zip code(46060). Every property was already owned by institutions as well, I just happen to have those listings. They purchased from other brokers as well who had listings in the zip they wanted to control.

I mostly left the business in 2012, after moving out of state for awhile. It is not something I really want to participate in anymore, and don't.

I'm going to make a pot of coffee cause I've got some reading to do and I don't think I would sleep much tonight anyway.

The securities you likely talked about in the article are MBS. If anyone has half a brain cell left they saw what happened with those in 2008. My advise is never invest in them, the fuse is already lit for 2008 part 2. This time it will not be mostly banks though, but retirement funds, state pensions, and anyone they can get to hold the bag. It is likely going to repeat though as soon as the hedge funds and institutions run out of cheap money to put into it(already happening hence the REIT crisis). MBS and fractional ownership of property was always a dumb idea, and still is. Sooner or later it all blows up again.Thanks for taking the time to give me the background. I've heard of plan but didn't realize how far it had been developed.

I'm going to make a pot of coffee cause I've got some reading to do and I don't think I would sleep much tonight anyway.

If you eat someone wouldn't you then get all their health problems? Of course the young healthy ones will be the hardest to catch. Do you take a chance on an old fat slow person? Damn more decisions..................

Well, you want to get one with good marbling

Cannibalism. Hmm.

Stay away from the clown, it tastes funny.

Firefighter has a smoky flavor.

What does the lady from Murder She Wrote and the grand dad from Blue Bloods say about this?

Two cannibals sit down to a meal, one starts at the head the other at the foot.

The one at the head asks the other, "Hey, how are you doing?"

The other replies, "I am having a ball!"

The first says, "Slow down, you are eating to fast..."

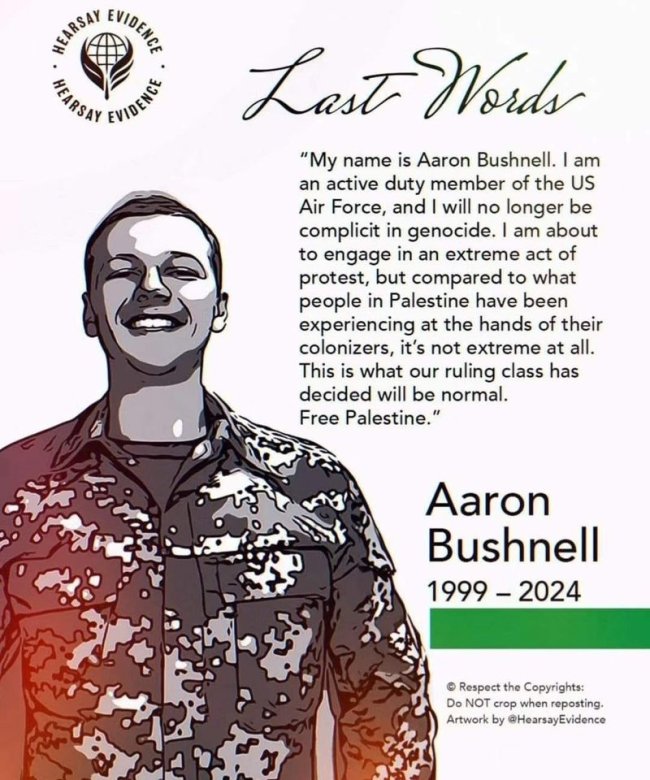

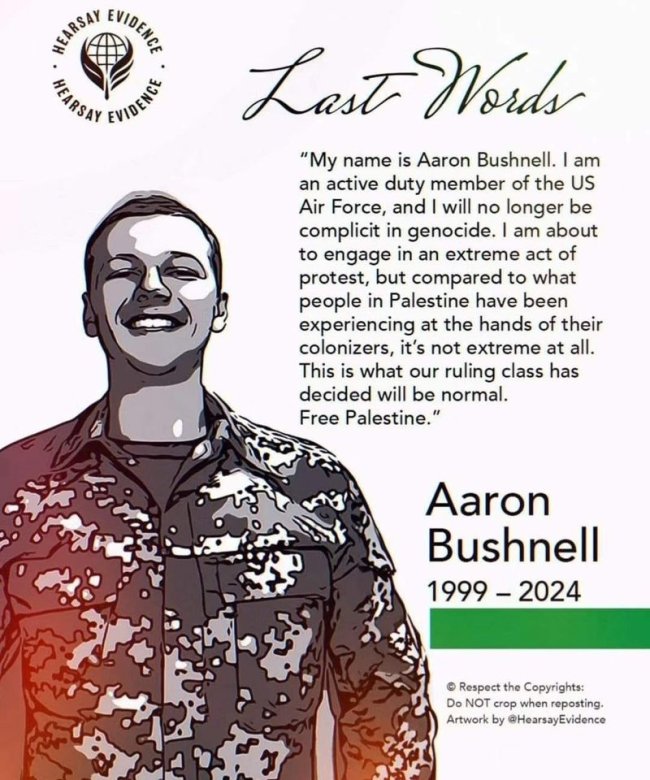

An active duty US Airman lights himself on fire outside the Israeli Embassy in protest of what he called a "genocide" of the Palestinian people.

https://nypost.com/2024/02/27/us-news/aaron-bushnell-claimed-secret-knowledge-of-us-forces-in-gaza/

Our nation has a SERIOUS problem with propaganda, and mental health.

This young dilutional Airman killing himself is being praised by the left as a brave act...

Hell, next thing we know there will be American suicide bombers running around.

https://nypost.com/2024/02/27/us-news/aaron-bushnell-claimed-secret-knowledge-of-us-forces-in-gaza/

Our nation has a SERIOUS problem with propaganda, and mental health.

This young dilutional Airman killing himself is being praised by the left as a brave act...

Hell, next thing we know there will be American suicide bombers running around.

Staff online

-

d.kaufmanStill Here

Members online

- Guffey

- Chevyman540

- hemicharger

- Tim1911

- rambokid

- DragonGunner

- Itchytriggerfinger

- d.kaufman

- Slow Hand

- shadow64

- dvd1955

- cosermann

- wisboy

- PGRChaplain

- Ingomike

- K9stang

- Damdamdon

- BScott

- mcoppers

- Timjoebillybob

- Fester

- Knight Rider

- 2500chev

- Brandon

- BeDome

- slims2002

- Gandalf

- El Conquistador

- Milo

- bobzilla

- TacOpsGuy320

- snorko

- INgunowner

- doddg

- hoosier88

- ductape

- mgross28

- Dog1

- Destro

- SmileDocHill

- tjones

- glank09

- longbeard

- jjohnson878

- Creedmoor

- Basher

- Encore460Mag

- Bowhunter34

- Jlangenberger

- indiucky

Total: 1,737 (members: 307, guests: 1,430)