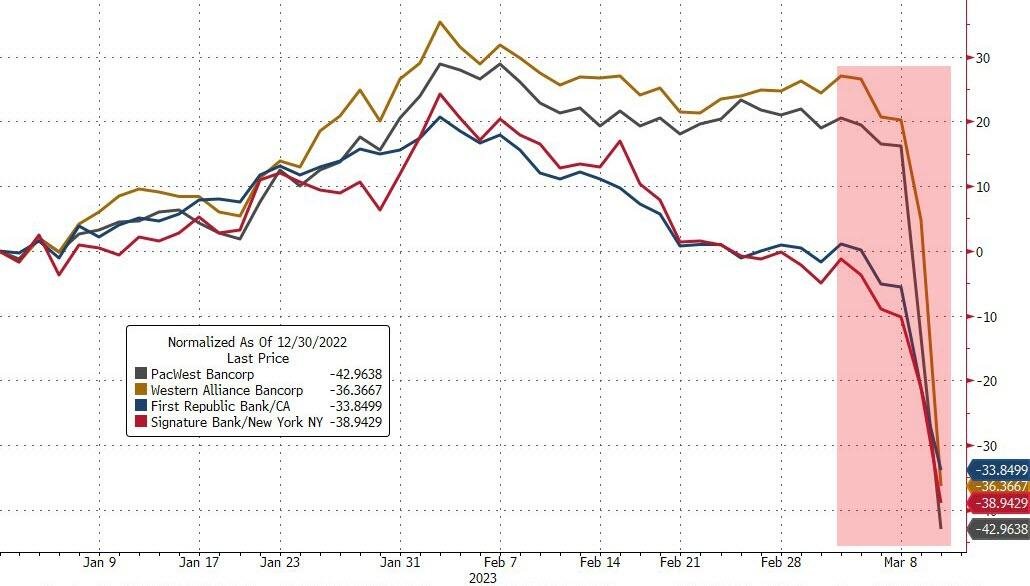

18th largest bank in the US.

www.zerohedge.com

www.zerohedge.com

Credit Suisse has fallen from the 9th largest bank in the world to below the top 50. The money from the Fed,US treasury,and IMF only purchased a few months of liquidity. It is still suffering more losses not just in depositors but held assets(article is from today 3/10/2023).

www.reuters.com

www.reuters.com

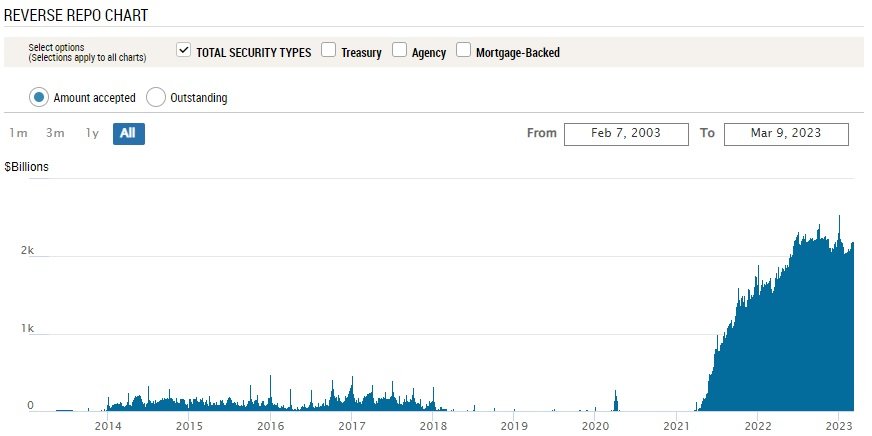

and yes US banks are still borrowing 2.2+ Trillion every day.

www.newyorkfed.org

www.newyorkfed.org

This should give you an idea of how healthy US banks are.

300 Billion Reasons Why SVB Contagion Is Spreading To The Broader Banking System | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Credit Suisse has fallen from the 9th largest bank in the world to below the top 50. The money from the Fed,US treasury,and IMF only purchased a few months of liquidity. It is still suffering more losses not just in depositors but held assets(article is from today 3/10/2023).

Credit Suisse shares hit new all-time low as banks hit by U.S. fallout

Credit Suisse shares hit a new all-time low in early trading on Friday as the European banking sector suffered the fallout from a sharp sell-off in U.S. financial stocks.

and yes US banks are still borrowing 2.2+ Trillion every day.

Reverse Repo Operations - FEDERAL RESERVE BANK of NEW YORK

This should give you an idea of how healthy US banks are.

Last edited: