6:30 am 10/4

Nasdaq 100 still bouncing around trying to stay above 14700. 14,705 currently(was down 14,589 when the the EU started opening for trade).

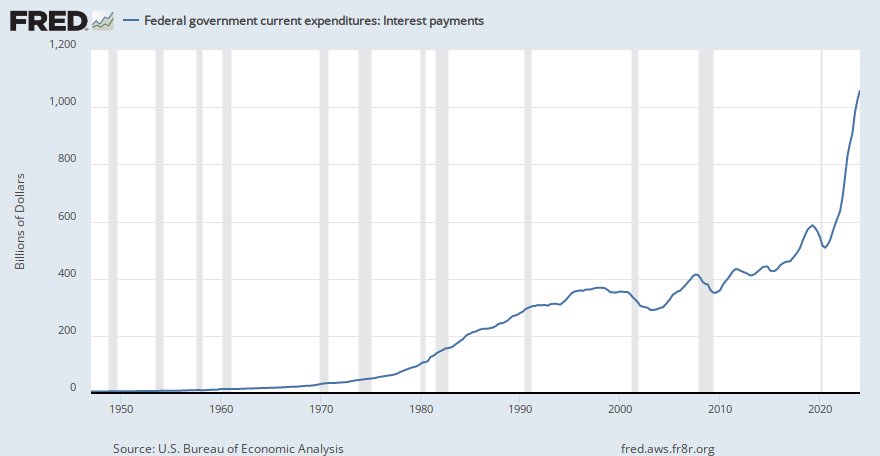

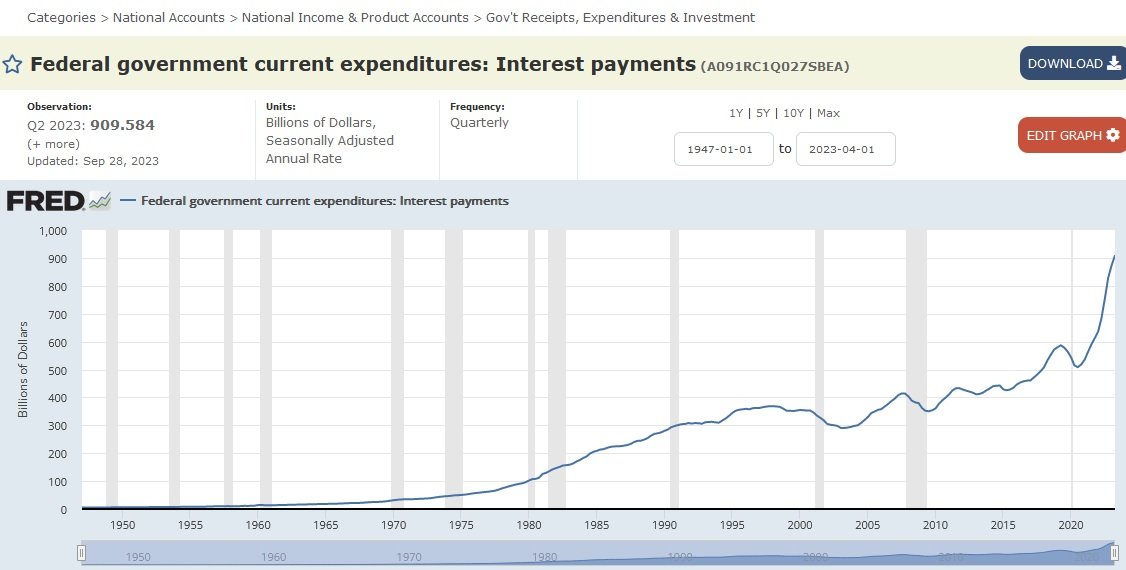

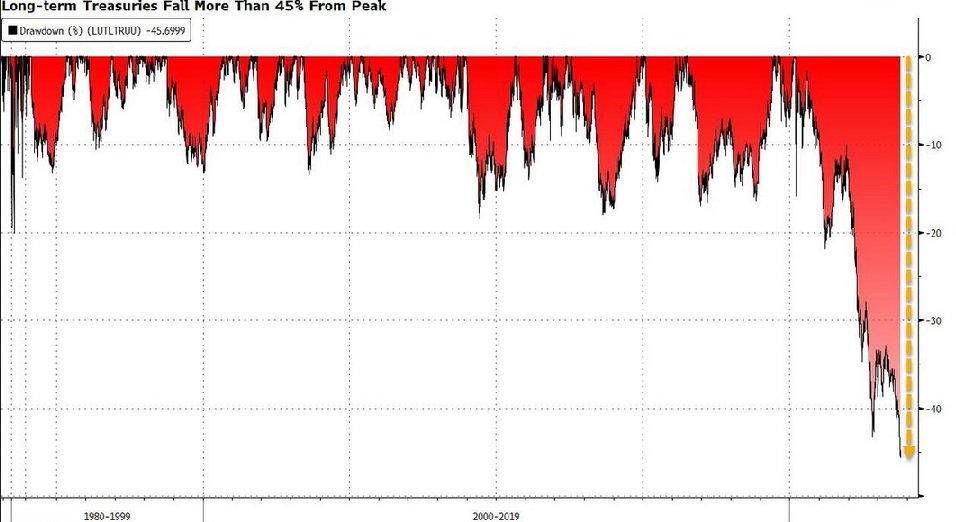

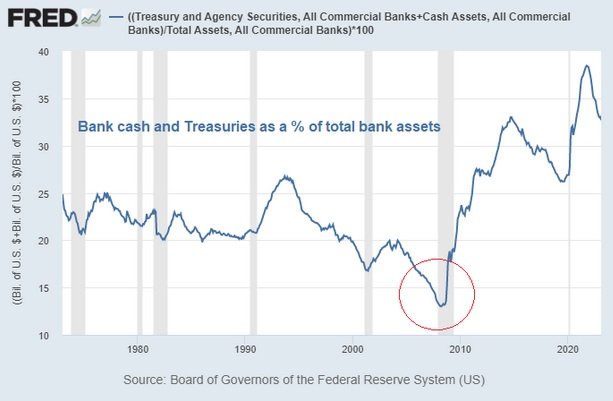

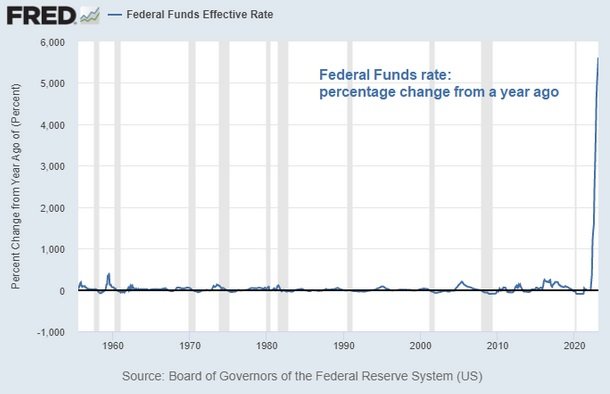

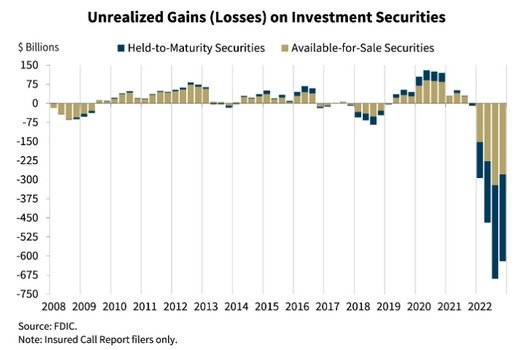

Back to bonds. It is ugly. Loads of articles about how high rates are going to destroy everything.

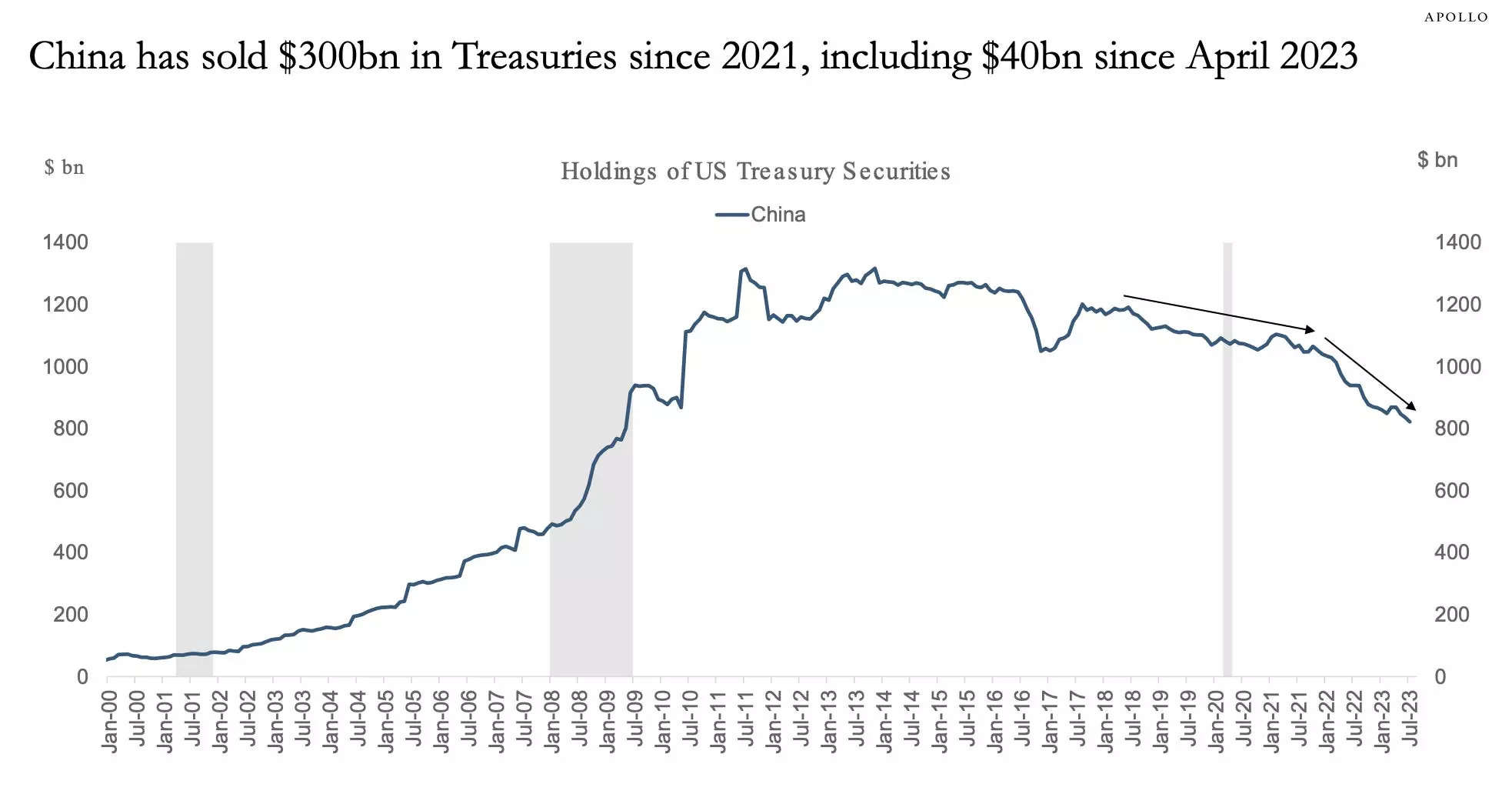

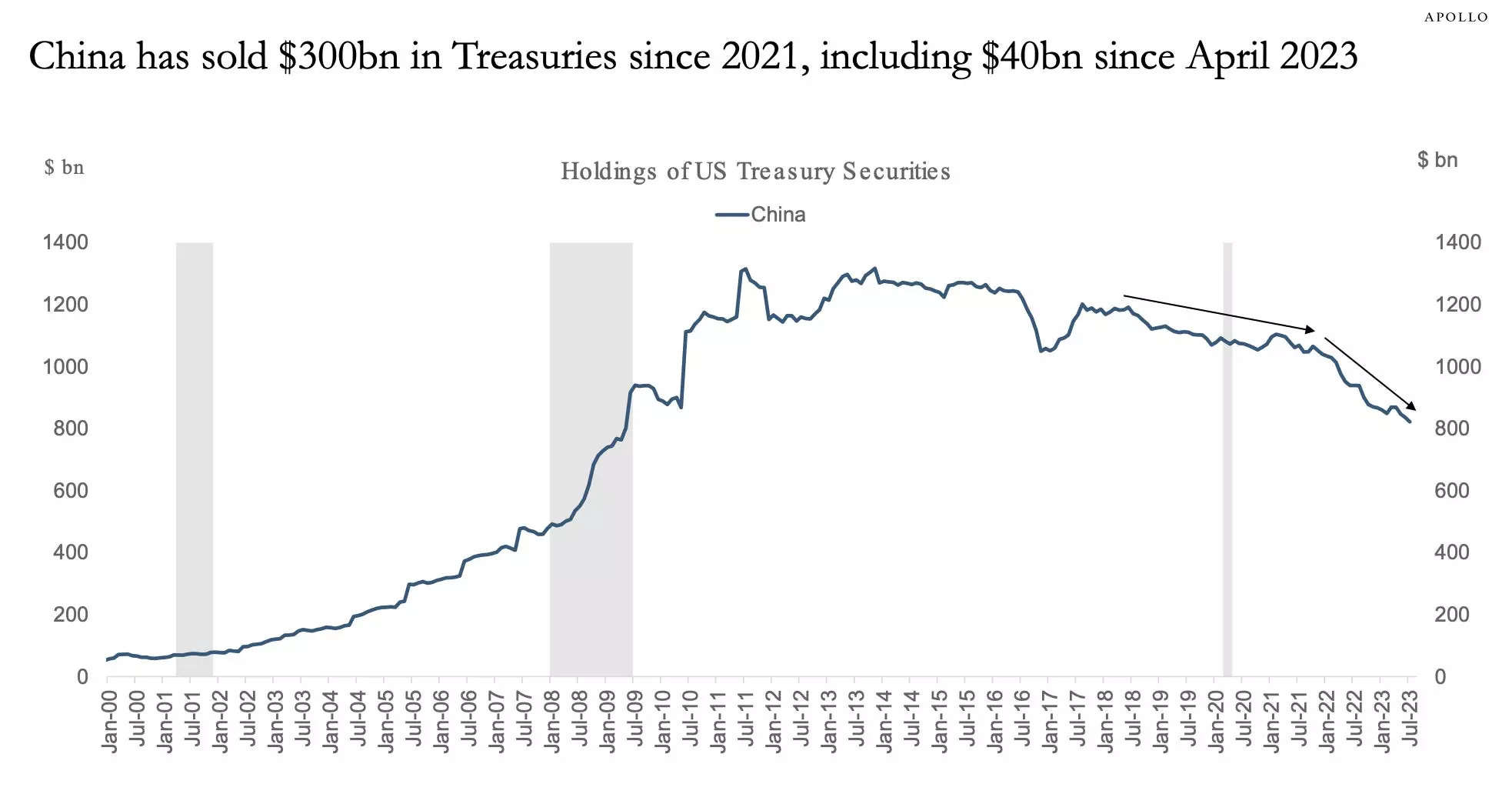

Some irony as well. China is down to almost below 80 billion in US treasuries...but they wrote this after they sold 40 billion(at a loss) so far this year.

www.businessinsider.in

www.businessinsider.in

Business insider is a strong defender of Biden's "economy"and more left than bloomberg(i know right!) who instead of blaming the 40 Billion china sold over the last 10 months mentions the gorilla in the room. The USA has sold almost 22 Billion in new bonds in the last month,and has another 85 billion or so to sell before the end of 2023. If you think bonds are bad now....well you have not seen anything yet,not even close...which is why JPM issued guidance about rates hitting 8% before year end(and mentioned they were one of the few banks who could handle it...video from yesterday).

www.bloomberg.com

www.bloomberg.com

Just to recap yesterday.

www.businessinsider.in

www.businessinsider.in

Nasdaq 100 still bouncing around trying to stay above 14700. 14,705 currently(was down 14,589 when the the EU started opening for trade).

Back to bonds. It is ugly. Loads of articles about how high rates are going to destroy everything.

Some irony as well. China is down to almost below 80 billion in US treasuries...but they wrote this after they sold 40 billion(at a loss) so far this year.

CHART OF THE DAY: China may be the source of surging US bond yields as Beijing dumps Treasurys

"Maybe China is behind the rise in US long rates," said Apollo's chief economist, noting that Chinese exports to the US are lower.

www.businessinsider.in

www.businessinsider.in

Business insider is a strong defender of Biden's "economy"and more left than bloomberg(i know right!) who instead of blaming the 40 Billion china sold over the last 10 months mentions the gorilla in the room. The USA has sold almost 22 Billion in new bonds in the last month,and has another 85 billion or so to sell before the end of 2023. If you think bonds are bad now....well you have not seen anything yet,not even close...which is why JPM issued guidance about rates hitting 8% before year end(and mentioned they were one of the few banks who could handle it...video from yesterday).

US Plans $103 Billion Debt Sale, as Issuance to Keep Rising

The US Treasury boosted the size of its quarterly bond sales for the first time in 2 1/2 years to help finance a surge in budget deficits so alarming it prompted Fitch Ratings to cut the government’s AAA credit rating a day earlier.

Just to recap yesterday.

Dow plunges 430 points as yields surge to levels not seen since 2007 and slam US stocks

Weekly job openings surged to more than 9 million, ahead of economist estimates, showing that the labor market is still resilient.

www.businessinsider.in

www.businessinsider.in

Last edited: