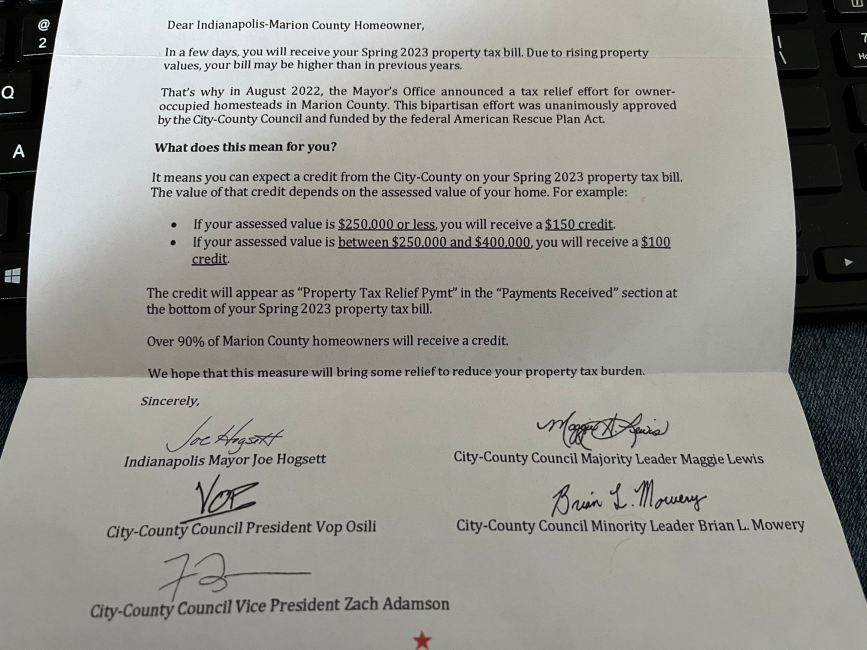

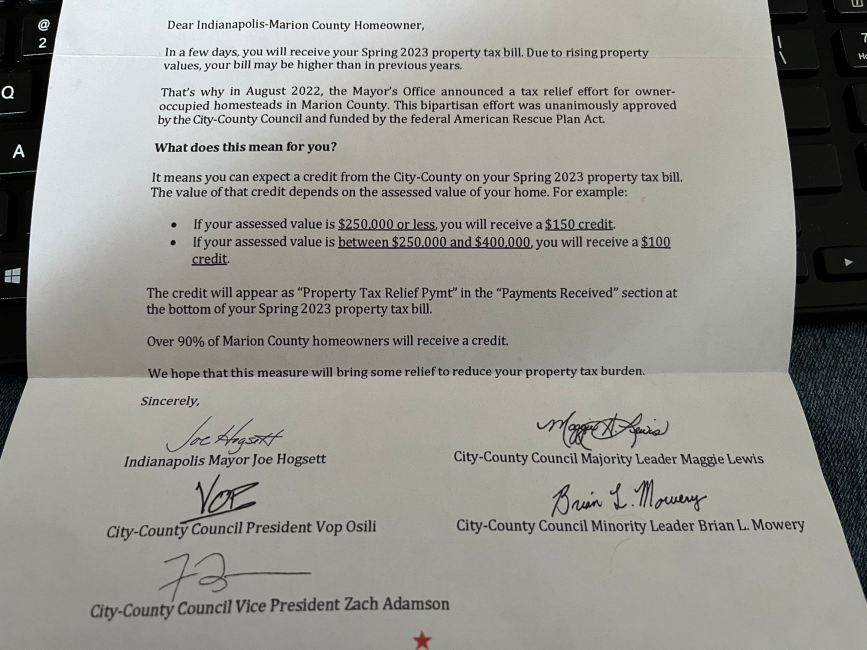

Got this letter today. I didn't even think about mentioning to anyone that my property tax went up this year. But this just pisses me off. My taxes went up over $340 and the mayor thinks he is doing us a favor by taking $150 back off. If you don't pay attention to your bill you would think you are saving money. End rant.