- Minimize monthly payments of any kind (loans/subscriptions/utilities).

- Take loans only for housing and vehicles.

- Buy nice but not excessive vehicles and replace only when needed (10+ years). After the loan is paid off keep an annual maintenance budget (3-5k). This will cover nearly any failure, still be less expensive than a replacement vehicle, and give you a start on the replacement if it isn't needed.

- Invest as much as you can in the various available resources

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Retirement Thoughts

- Thread starter firecadet613

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Vehicles are a waste of money.

- Minimize monthly payments of any kind (loans/subscriptions/utilities).

- Take loans only for housing and vehicles.

- Buy nice but not excessive vehicles and replace only when needed (10+ years). After the loan is paid off keep an annual maintenance budget (3-5k). This will cover nearly any failure, still be less expensive than a replacement vehicle, and give you a start on the replacement if it isn't needed.

- Invest as much as you can in the various available resources

2006. 2009. 2016 are the 3 we have. I mean if you are above middle class and have money to blow blow it sure.

When I was answering the OP, I wad answering for middle class. Someone who wants 70k-120k per year in retirement

That 3-5k budget can be shared across Vehicles too. If that envelope is full then that money can go elsewhere like into savings so you don't need a loan for the next car. Also liability insurance after 5 years or so saves money.

Damn @foszoe, nice!One thing that gets overlooked is the legal protections are different for 401ks vs IRAs also. I believe it's harder to sue you for money in a 401k.

Maybe there's a lawyer here that knows.

I personally max out 401k contributions when the allowance goes up every year. I have what is called Fidelity Brikeragelink so i can invest most of my 401K in stocks, bonds, etc of my choosing. Max out an HSA. Max a spousal IRA because she doesn't work. Then MAX contribute to my Roth IRA. Then what's left for investment goes in a trading account.

That's my investment mechanisms. Then you have to come up with an investment strategy.

The wife has an IRA and a 401k, I just have the 401k which we both max out.

Honestly, we should have looked at this a few years ago and doubled down sooner, but without any debt we can really stash some cash away.

Are you doing the RR class on the 23rd?

- Minimize monthly payments of any kind (loans/subscriptions/utilities).

- Take loans only for housing and vehicles.

- Buy nice but not excessive vehicles and replace only when needed (10+ years). After the loan is paid off keep an annual maintenance budget (3-5k). This will cover nearly any failure, still be less expensive than a replacement vehicle, and give you a start on the replacement if it isn't needed.

- Invest as much as you can in the various available resources

Amen to that, the Dave Ramsey plan. We sorta followed it. I didn't sell my 150k boat and I paid cash for my used 50k pickup... but you gotta live.

Our debt is non existent and we really have no wants (if I can stay out of the classifieds here), so really just looking for retirement investment thoughts as we mentor our younger friends on the steps we took during our 20s and first half of our 30s.

I sound better off than I am but it's what I have done since I was mid 30s when I started making enough to save. I hope you do well.Damn @foszoe, nice!

The wife has an IRA and a 401k, I just have the 401k which we both max out.

Honestly, we should have looked at this a few years ago and doubled down sooner, but without any debt we can really stash some cash away.

Are you doing the RR class on the 23rd?

It's cliche but start where you are not where you wish you could have been.

Learn from the past, plan for the future, but dwel always in the present, for to dwell in the past is to live in regret, to dwell in the future is to live in anxiety, but the dwell in the present is to live among friends.

Having 2 good incomes puts you ahead of a lot of people. Probably not on INGO, but the average guy you pass on the street is not as good as you are.

No debt is key!!!

My knee has gotten worse so no classes for awhile. Ortho doctor and MRIs more likely.

I appreciate the advice. We still have many working years left and I'll be honest, what I do for work doesn't feel like work so I can do it a long time still.I sound better off than I am but it's what I have done since I was mid 30s when I started making enough to save. I hope you do well.

It's cliche but start where you are not where you wish you could have been.

Learn from the past, plan for the future, but dwel always in the present, for to dwell in the past is to live in regret, to dwell in the future is to live in anxiety, but the dwell in the present is to live among friends.

Having 2 good incomes puts you ahead of a lot of people. Probably not on INGO, but the average guy you pass on the street is not as good as you are.

No debt is key!!!

My knee has gotten worse so no classes for awhile. Ortho doctor and MRIs more likely.

Damn. Prayers for healing. In my line of work I speak with the average American and millionaire's during my day and the one theme amongst all the "rich" guys is the same....health and family is everything...

Great advice above from others! I'll emphasize that you should prioritize saving AND investing consistently. Compounding interest is a powerful thing. Also control/eliminate debt. These keys, along with time, are your best asset and are very powerful in reaching your goals.

I believe that financial advisors can be helpful at times (especially fee-only), but you will always be your best advocate for your money and financial future. Even if you hire a financial advisor, and can justify the cost, make sure YOU understand the advice and recommendations you receive before committing to any strategy or investment.

To help plan and learn, here's a link to a tool that is extremely useful. It's very powerful. Also check out Rob Berger and Joe Kuhn (and others) on YouTube for insightful knowledge.

Lastly, early in life...you'll find that money is more important than time. As you grow older, you'll realize that time begins to outweigh the value of money. Do your best to get to financial freedom so that you can choose how to spend your valuable time. Good luck!

I believe that financial advisors can be helpful at times (especially fee-only), but you will always be your best advocate for your money and financial future. Even if you hire a financial advisor, and can justify the cost, make sure YOU understand the advice and recommendations you receive before committing to any strategy or investment.

To help plan and learn, here's a link to a tool that is extremely useful. It's very powerful. Also check out Rob Berger and Joe Kuhn (and others) on YouTube for insightful knowledge.

Lastly, early in life...you'll find that money is more important than time. As you grow older, you'll realize that time begins to outweigh the value of money. Do your best to get to financial freedom so that you can choose how to spend your valuable time. Good luck!

Last edited:

While vehicles are a depreciating asset and an expense, they are far from a waste of money. Most people need them to facilitate everything they do. To that end I say get something nice that will fill all your transportation needs for years to come rather than trying to value engineer it and hating every moment of ownership. Until very recently our youngest vehicle was 2011. We just picked up a 2021 in November to fill our changing family needs and it will likely serve us for the next decade. That said while our vehicles are older, we do not by cheap vehicles and thus we do not buy them often and they still feel nice when they get older as well. The 2011 still outclasses the rentals we get when vacationing.Vehicles are a waste of money.

2006. 2009. 2016 are the 3 we have. I mean if you are above middle class and have money to blow blow it sure.

When I was answering the OP, I wad answering for middle class. Someone who wants 70k-120k per year in retirement

That 3-5k budget can be shared across Vehicles too. If that envelope is full then that money can go elsewhere like into savings so you don't need a loan for the next car. Also liability insurance after 5 years or so saves money.

While vehicles are a depreciating asset and an expense, they are far from a waste of money. Most people need them to facilitate everything they do. To that end I say get something nice that will fill all your transportation needs for years to come rather than trying to value engineer it and hating every moment of ownership. Until very recently our youngest vehicle was 2011. We just picked up a 2021 in November to fill our changing family needs and it will likely serve us for the next decade. That said while our vehicles are older, we do not by cheap vehicles and thus we do not buy them often and they still feel nice when they get older as well. The 2011 still outclasses the rentals we get when vacationing.

I could have been more precise.

Vehicles are a necessary evil, except when camping

I could be more precise. In my opinion, and this is where the real line is for me. There is a point where the bells and whistles people go in debt for on a vehicle is a waste of money. As I said above, that line is income dependent. If you are making an above average salary, and can truly afford it then buy it. That is why its called personal finance. For the circles I run in, most of them shouldn't be spending more than $50K on a car, $60K on a truck, with 30-40K being what I would call affordable. We are looking at replacing the 2006 in the next year or 2. In 2006, it was 35K. We are looking at a Subaru Outback Touring which is pricing at 42K. Putting aside $150/mo over the years we didn't have a loan on the 2006 has over 50K in the bank to pay for it.

I've been doing FIRE for a long while. Every time I got a raise or started a new enterprise, I kept my living standard the same and placed all the additional money (after taxes) into retirement savings.

Priorities:

1. Max out 401(k). Either traditional, ROTH, or a mixture of the 2.

2. Stock market in after-tax account. Mostly low-expense ETFs

3. Bond market. Fidelity lets you buy both the primary and secondary market. Build a good CD / Bond ladder. (So do several other sites, but IMO Fidelity is the best for this.)

4. Investment property. Lots of work though, not for everyone

5. Other assets. Precious metals or other non-traditional assets

Also, get rid of debt.

1. Don't buy anything unless you can pay cash. This includes vehicles.

2. Pay down your mortgage aggressively. Now if you have a low interest rate from a few years ago, then bank the extra money instead for now. But once savings rates fall back down in a few years, go back to paying down the mortgage.

Priorities:

1. Max out 401(k). Either traditional, ROTH, or a mixture of the 2.

2. Stock market in after-tax account. Mostly low-expense ETFs

3. Bond market. Fidelity lets you buy both the primary and secondary market. Build a good CD / Bond ladder. (So do several other sites, but IMO Fidelity is the best for this.)

4. Investment property. Lots of work though, not for everyone

5. Other assets. Precious metals or other non-traditional assets

Also, get rid of debt.

1. Don't buy anything unless you can pay cash. This includes vehicles.

2. Pay down your mortgage aggressively. Now if you have a low interest rate from a few years ago, then bank the extra money instead for now. But once savings rates fall back down in a few years, go back to paying down the mortgage.

Sounds like we have similar thoughts on vehicles. We prioritize size (3 kids), comfort, and driving characteristics (~8 hour trips) over technology. I don't think the sales person knew what to do when I test drove the 2021. He asked if I wanted to know how the infotainment and climate control worked. I simply replied that I wanted to see how it drove. I fired it up, turned off the radio, tinkered a little with the drive modes and then proceeded to see how it drove and handled. All the tech was just a bonus, or hinderance in some cases, for us. I had to turn several of the driving "aids" off on our first road trip. The most troublesome was the speed limit adoption. At every speed limit sign it would try to aggressively reduce or increase speed to the posted limit even though traffic was flowing at a different rate. Then at one point it mistook a highway 80 sign for an 80mph speed limit sign.I could have been more precise.

Vehicles are a necessary evil, except when camping

I could be more precise. In my opinion, and this is where the real line is for me. There is a point where the bells and whistles people go in debt for on a vehicle is a waste of money. As I said above, that line is income dependent. If you are making an above average salary, and can truly afford it then buy it. That is why its called personal finance. For the circles I run in, most of them shouldn't be spending more than $50K on a car, $60K on a truck, with 30-40K being what I would call affordable. We are looking at replacing the 2006 in the next year or 2. In 2006, it was 35K. We are looking at a Subaru Outback Touring which is pricing at 42K. Putting aside $150/mo over the years we didn't have a loan on the 2006 has over 50K in the bank to pay for it.

Vehicles are all about how you do it. I like high end full size pickups and I cannot lie...

I've had a '14 F150, ordered a '16 F150, ordered a '19 Ram then went back to a company vehicle and sold it. Now I've got another '19 Ram in the garage thats hooked to a battery tender (it rarely gets driven).

Both F150s were traded in at two years and 60,000 miles, for $10,000 less than I paid.

Having a car allowance helped, but regardless it wasn't too painful. Buying the current one taught me how dealers aren't really setup for paying cash (unless you can wire the money during banking hours). It ended up being easiest letting the dealer finance the truck and paying it off immediately.

I've had a '14 F150, ordered a '16 F150, ordered a '19 Ram then went back to a company vehicle and sold it. Now I've got another '19 Ram in the garage thats hooked to a battery tender (it rarely gets driven).

Both F150s were traded in at two years and 60,000 miles, for $10,000 less than I paid.

Having a car allowance helped, but regardless it wasn't too painful. Buying the current one taught me how dealers aren't really setup for paying cash (unless you can wire the money during banking hours). It ended up being easiest letting the dealer finance the truck and paying it off immediately.

I've been doing FIRE for a long while. Every time I got a raise or started a new enterprise, I kept my living standard the same and placed all the additional money (after taxes) into retirement savings.

Priorities:

1. Max out 401(k). Either traditional, ROTH, or a mixture of the 2.

2. Stock market in after-tax account. Mostly low-expense ETFs

3. Bond market. Fidelity lets you buy both the primary and secondary market. Build a good CD / Bond ladder. (So do several other sites, but IMO Fidelity is the best for this.)

4. Investment property. Lots of work though, not for everyone

5. Other assets. Precious metals or other non-traditional assets

Also, get rid of debt.

1. Don't buy anything unless you can pay cash. This includes vehicles.

2. Pay down your mortgage aggressively. Now if you have a low interest rate from a few years ago, then bank the extra money instead for now. But once savings rates fall back down in a few years, go back to paying down the mortgage.

FIRE? We've done the same and are both making considerably more than when we got married.

To your point, the life style is huge! We know many who bought a new car or larger house every time they got a new job or promotion, we never did. Which allowed us to payoff our house two years ago...

Financial Independence, Retire Early.FIRE?

I am about to hang it up now. I don't know if I have "enough" but I am at the point where I am fairly miserable daily. I turn 64 this year. So I may just wing it. I have enough in my HSA to pay to COBRA my group medical until Medicare would kick in.

To paraphrase a sentiment from above, one of my favorite quotes about retiring ASAP is: "There's always a chance you might run out of money, but you're guaranteed to run out of time."I am about to hang it up now. I don't know if I have "enough" but I am at the point where I am fairly miserable daily. I turn 64 this year. So I may just wing it. I have enough in my HSA to pay to COBRA my group medical until Medicare would kick in.

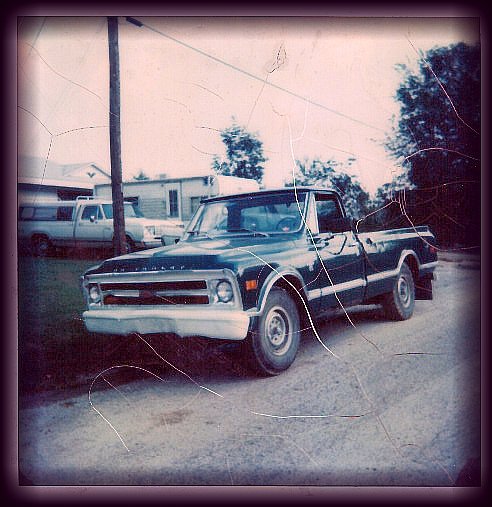

Give me a 68, 3/4 ton Chevy, 4-speed (granny with 2nd out), and I'm happy as a clam.Vehicles are all about how you do it. I like high end full size pickups and I cannot lie...

I've had a '14 F150, ordered a '16 F150, ordered a '19 Ram then went back to a company vehicle and sold it. Now I've got another '19 Ram in the garage thats hooked to a battery tender (it rarely gets driven).

In fact, that's a part of my "living below your means".

Wife and I:

maxed 401k/403b match contributions.

almost maxed roth IRA's for each of us.

Ensured we have zero debt, this has allowed us to put back more money for things.

Her TRF will still be providing both a guaranteed pension amount plus her contributions as an additional benefit.

We are currently on track to be retired at 57 from full time work. We will need to have some other income just to cover insurance until 65 so we know we will be working part time things until then. I already have a plan for that. She is still working on it.

Our current quality of life is: we do whatever we want. We pay cash. We enjoy. In fact we have a cruise coming up very soon, I've spent $5k the last two years to compete in OLoA, I still go racing though on a budget. We both purchased new cars in the last 15 months and just this week closing on property in florida to retire to.

maxed 401k/403b match contributions.

almost maxed roth IRA's for each of us.

Ensured we have zero debt, this has allowed us to put back more money for things.

Her TRF will still be providing both a guaranteed pension amount plus her contributions as an additional benefit.

We are currently on track to be retired at 57 from full time work. We will need to have some other income just to cover insurance until 65 so we know we will be working part time things until then. I already have a plan for that. She is still working on it.

Our current quality of life is: we do whatever we want. We pay cash. We enjoy. In fact we have a cruise coming up very soon, I've spent $5k the last two years to compete in OLoA, I still go racing though on a budget. We both purchased new cars in the last 15 months and just this week closing on property in florida to retire to.

Buying the current one taught me how dealers aren't really setup for paying cash (unless you can wire the money during banking hours). It ended up being easiest letting the dealer finance the truck and paying it off immediately.

Really? I've never had any problem. Dealers have always accepted a personal check. (I think once I had to provide a cashier's check for a car I was buying out-of-state.) I wonder if they "said" it was easier just to get you to finance. They were hoping you wouldn't pay it off immediately.

Latest posts

-

-

-

The Czickness LII….it is the grey time of year. Tungsten Grey that is…

- Latest: patience0830

-

Staff online

-

GodFearinGunTotinSuper Moderator

-

d.kaufmanStill Here

Members online

- flint stonez

- rkwhyte2

- WebSnyper

- Creedmoor

- Noble Sniper

- Milo

- joncon

- opus1776

- GodFearinGunTotin

- vzdude

- markiemark

- bocefus78

- mkgr22

- Leadeye

- littletommy

- crookcountygo

- fullmetaljesus

- draftyranger

- Bugzilla

- hoosierdaddy1976

- DDadams

- maxipum

- PlaysInTheDirt

- indyartisan

- Ark

- Dmac22

- canebreaker

- d.kaufman

- melensdad

- t-squared

- deo62

- jbm1521

- byggpoppa

- knutty

- Averygc

- Meatstick

- Steel and wood

- jamil

- Angrysauce

- futureofwar

- Ted@

- eric001

- dung

- patience0830

- boosteds13cc

- Geoman1

- tjh88

- jagee

- chef larry

- Vanguard.45

Total: 1,749 (members: 234, guests: 1,515)