hoosierdoc

Freed prisoner

nice. hopefully you bought low.i cashed in in CHEK 2 days ago.

nice. hopefully you bought low.i cashed in in CHEK 2 days ago.

i believe aphria will go places.I bought 200 ACB after hours. planning to sell puts tomorrow and covered calls.

Dem control may mean legalization

apparently they just mine crypto. With the way bitcoin is going, might not be a bad idea. I put all the money i made from CHEK into bitcoin, and it's like finding money in the pair of jeans that you wore last week.insane last few days. I have 8 AMD puts.

looked at MARA last week but did not buy as I didn't understand what they did

yes, that ship sailed i think. Dec 1 was cutoff.Hey Doc....Was it you who had contact info and some information on MeWe stock?

I replied in the original about Elon Musk and his understanding of how our monetary system actually worked.

He is now the richest man on earth having made more than 100 billion in 2020. Tesla alone was up

743% in 2020 and it is not nearly all he owns.

I also said I would wait until January 10th to re-enter the market.

The FED is twisting in the wind. Some members saying they will tapper and end all US Treasury purchases, while another FED bank head said they would not.

More stimulus is in the works and the dollar has weakened. Lockdowns, debt, unemployment, manufacturing, and the service industries are all huge negatives for growth.

Does anyone else remember back in 2012-13 the message in financial publications was how the USA had transitioned to a service economy? I pointed out then it was not possible to base an economy on anything other than mining, growing, or making things.

I will watch what the FED does,not what heads of specific branches of it say they are going to do.

If they actually taper one thing is guaranteed and that is rates will go up.

People still need to eat. Energy will still be used.

The dollar may weaken,but then again I learned in 2009-12 it may not if every bank on earth follows the FED and does their own stimulus programs. It is all about percentages. If they match the FED(say EU) in the percentage of their respective currency the dollar will lose purchasing power,but not paper value. I remember joking about DOW 20,000 based on FED stimulus. We blew right through it and now through 30k. At this point, DOW 60k in the next 4 years would not even surprise me.

So where do I want to be?

Sidelines are not really an option. Sure gold and silver(physical) are likely great investments.

Energy prices are likely to go up,but the companies themselves may suffer greatly if we get a "green" new deal. Same for miners. So I will mostly go into commodities and reap the gains while avoiding any specific company and political risk.

That is what I am looking at for 2021.

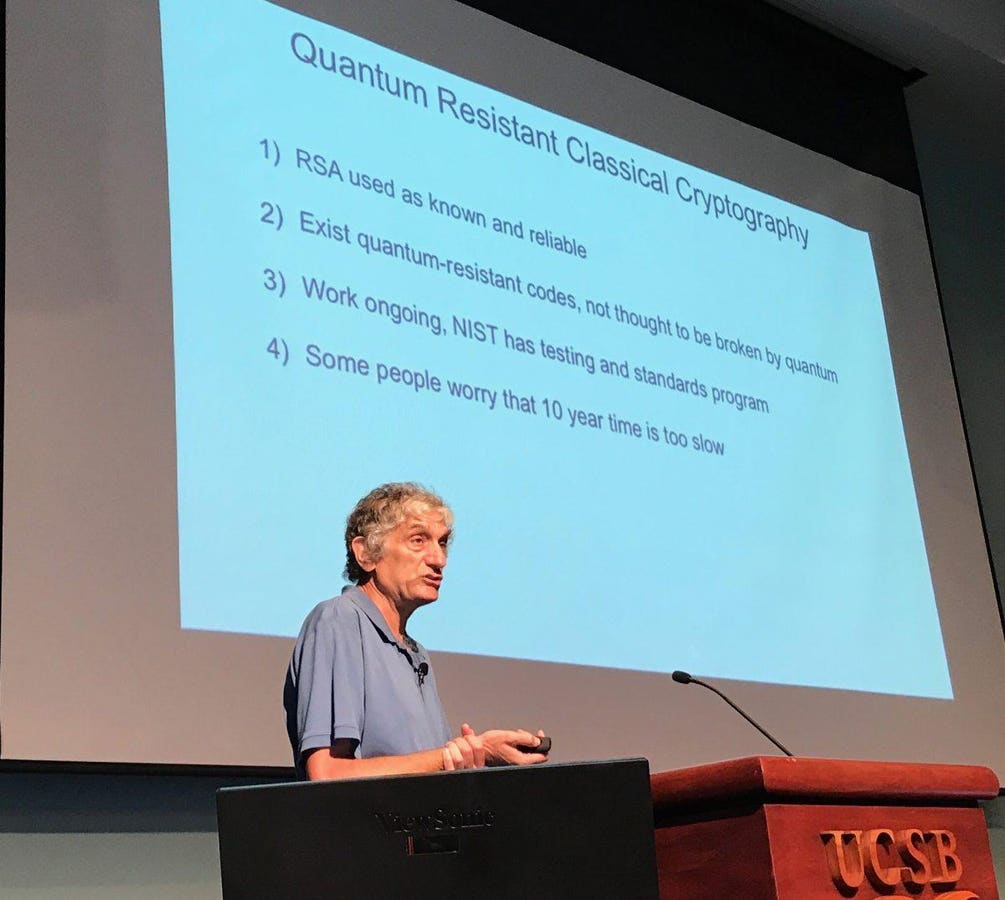

*side note. I give all digital currencies currently in use 2-5 years before they are entirely worthless. Why? They can not be secured against quantum computers that already can break into the best encryption on earth in minutes. It will take a while for that reality to set in for most. You can not secure 1,0 with 1,0 and expect it to actually be secure against 1,2,3,4,5, infinity.

And yes I think digital banking itself is at risk.

www.forbes.com

www.forbes.com

I get asked alot about. My Iron Fly strategy so I thought I would make a detailed post. After doing this Iron Fly trade since June 2019, I'll never sell an Iron Condor ever again. The premium decay is just way too slow on the OTM calls and puts. I would much rather be in a trade 1 hour with an Iron Fly than a 5-6 hours with IC or vertical spreads.

My rules are simple.

I only do 0-DTE trades.

Sell the open with $50 wings. I sell the strike closets to the current price when market opens.

Take profit at credit recieved - $1.50

So time I hold for more profit. Either way I like to be out in 1 hour or less.

My stop is based on sold strike + or - credit received.

So today I sold the $3020 put and call at the open. I bought $2970 put and the $3070 call. Credit was $24.70. Since I use $50 wings it took $25.30 x 10 contracts = $25,300 in buying power to put this trade on.

So with my rules I will have a stop at

$3020 - $24.70 = $2995.30 on the downside

$3020 + $24.70 = $3044.70 on the upside

I us TD Ameritrade and set a market order to be sent if SPX drops below $2995.30 or above $3044.70. If Im stopped out this will result in a $2-4 loss.

Today I closed 1 for $1.50 gain. I meant to close 5 but somehow made a mistake

I closed 4 for $2.05 gain

I closed the last 5 for a $5.00 gain.

Total Profit on the trade $3,470

Some tips for new people that want to try it.

#1 don't look at your P/L. It is very jumpy the first 15 minutes and will often tell you are red $1+.

#2 don't use TOS to paper trade it. It will give you ******** fills that you would never get in real life. Instead I recommend just watching the mid price of the trade. To get out you need to see the mid price go past $.15-.20 your exit price. This way it is realistic unlike TOS paper.

#3 make sure you have a profit order already waiting to get filled. The market can make very quick drops or jumps and you will get filled.

#4 The wider the wings the better. For example if you do $30 wings instead of $50 it will take you longer to profit because the bought wings have more premium decay than the $50 wings do.

#5 If you get tested near the stop. I will often change my exit to a smaller profit target or even the credit received.