Now down over $16 per barrel. Sitting at $1.80 per barrel

No I know what to do with all the pennies I've been hoarding...

Oil crashes 99% to 1 cent per barrel

Now down over $16 per barrel. Sitting at $1.80 per barrel

Now down $54 per barrel. -$34

I posted this back on March 27th.

https://www.bloomberg.com/news/arti...s-oil-market-has-already-seen-negative-prices

They kept it up artificially until the contracts where ending and you had to have storage to hold it.

It will cause a gigantic spike in prices to the upside. It will cause mass shut downs and many oil companies will not survive.

Enjoy the cheaper gas now because it will not last,and any slight uptick in demand will cause much higher prices.

It is another problem that will drag on for years. I can easily see $5.00 per gallon by Christmas if not then by early next summer.

The -$37 oil is only on the May contracts expiring today. It’s not the “real” price. Oil will return to the positive range tomorrow when the June contracts begin. Will still be low, but not negative.

As far as $5.00 a gallon gas by Christmas, that ain’t happening. Cheap oil will stop the US shale and fracking only while the price is low, but as soon as oil hits $45-$50 a barrel it will come right back online and stabilize the gas at $2.50 like it has been the last couple years.

The paradigm has changed the last 5 years. We only need Mideast oil if the price is right. It gets too high and US shale and fracking start pumping and the price goes back down. 10 years ago those shale and fracking fields were ran by small companies that would be bankrupt now. But today, they are controlled by Big Oil like Exxon who have the money and resources to just freeze production and come back online when the price comes back up.

Many Americans are still living under the old assumption that we are at the mercy of Mideast oil, and it just isn’t reality anymore.

With that note, Smokingman, where would one look to buy futures or the equivalent of call options if this were an equity stock?

No oil company is going to start production they are now having to shut down to lower the price. If they where small companies still they might,just to make money. The fact as you point out most of the fracking is now run by giant oil companies is why the price will spike. They will want every barrel to be worth as much as possible,and it will be a struggle for them against imported cheap oil. I can not see them restarting a single well at even 45-50 a barrel.

Do you have any reason to believe they want oil prices to be lower?

It will be tanker oil being cheap that will limit how high the price can go,not US producers that want the price higher.

Yeah, that's what I was trying to say. It's OPEC who wants higher priced oil to prop up their oil heavy economies. Yes, US oil companies want higher priced oil as well, but it's OPEC and Russia in particular that made the decision to pump more oil to drive the price low to push out the US shale industry. Once we are out, they think that will push oil higher and they are left alone to take in the bounty.

What I am saying is as soon as that oil price swings back to $50, US shale will come back online because there is profit to be made at that price.

OPEC in recent years has pumped less to keep oil prices steady, but steady oil prices means more US shale. So OPEC loses either way.

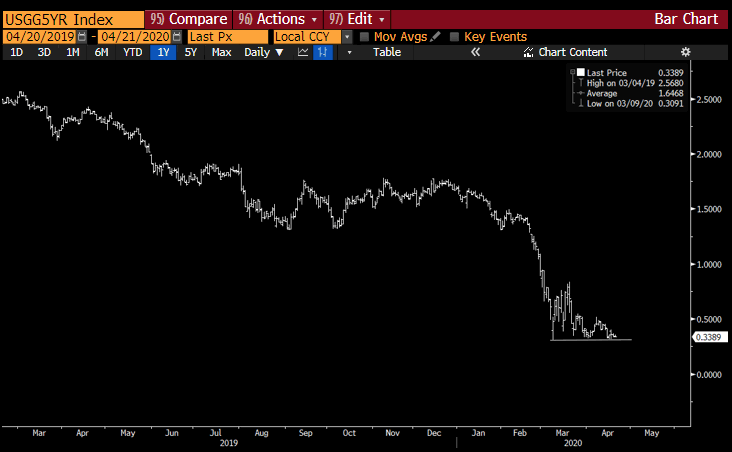

That's a yield chart, isn't it?

yes.

Negative yield on 5 year. I posted a link to the 10 year(live). History is being made.

https://www.zerohedge.com/energy/in...8-million-loss-after-oil-trading-clients-bust

Interactive Brokers Stuck With $88 Million Loss After Oil-Trading Clients Bust

[FONT=lucida_granderegular]CNBC: "Across the industry, do you think there is going to be some really serious pain?"[/FONT]

[FONT=lucida_granderegular]Peterffy: "There is about another half a billion dollars of losses that somebody is sitting on... and I do not know who those folks are."[/FONT]

Hope your broker isn't in the same boat.