Part of credit score is demonstrating a history of paying off debt. I never heard of that lowering one's FICO score; in fact, a good way to lower your score is to lower your credit usage/credit availability ratio. Applying for and using a new credit card, for example, temporarily lowers your credit score, because average account age is lowered. But as long as you don't go crazy and carry balances, your low credit usage really bumps up your score. We applied for an Amazon Visa, which we only use on Amazon for the 5% cash back, and pay off monthly. We were approved with a ridiculously high line of credit. Within 2 months, our FICO score jumped 20 points. I found out that having an excellent credit rating not only impacts on available loan rates, but cars insurance as well.A credit score is essentially your "I love debt score" and shows how much you like playing kissy face with the bank. Paying down debt lowers your score because the calculation rewards you for borrowing lots of money.

Stop playing the game and stop borrowing money. Then you won't ever worry about your score again.

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Here They Come Again,This Time Mortgages…

- Thread starter Ingomike

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

No, the homestead is your personal residence and does not matter if you have a loan or not. Better check, if you own a home, that you have the exemption.Help me understand please.

I thought the Homestead exemption went away when you paid off your home?

Is that not the case?

I remember thinking that if I retired with a million dollars that I'd be Thurston Howell III rich.I'll state up front that I drink the Ramsey Kool-Aid and follow his plan.

That out of the way, Dave Ramsey and his Baby Steps has created more millionaires than anyone else walking the earth. There is no one else that has helped more people build wealth than him.

You can disagree with his approach, but I'm not sure how you can say his "financial advice sucks" based on the results people get by following it.

If someone could get a HELOC at 3% would you also recommend they borrow against it to invest?

The Ramsey team conducted the largest study on millionaires ever done in North America, surveying more than 10,000 of them. There was no data that showed people get rich by borrowing lots of money on low rate mortgages and investing the difference. None.

I'm sure some have done it, but it was not a common trend line among people that built wealth. In fact, the data shows the opposite. People build wealth by paying off their mortgages and freeing up their income to invest.

The mortgage tax credit is trading a dollar for a quarter. Why would anyone keep a mortgage around just so they could pay $10,000 to their mortgage company to get a $2,500 credit? That math doesn't add up on that.

Not to mention that in order to claim the mortgage tax credit you'd have to itemize deductions rather than taking the standard deduction, which almost no one does anymore since the amount doubled. Approximately 9 out of 10 people were expected to take the standard deduction on their 2022 returns.

Standard Deductions for 2023 and 2024 Tax Returns, and Extra Benefits for People Over 65

Each year when you fill out your federal income tax return, you can either take the standard deduction or itemize deductions to reduce your taxable income. The overwhelming majority of taxpayers claim the standard deduction, because due to changes in tax law, few people find it worthwhile to itemizewww.forbes.com

The mortgage exemption is gone as posted above.The mortgage exemption goes away if you have no mortgage/pay off your loan. Note, if you refinance you should refile the exemption.

Not exactly. Your homestead home is maxed at 1% property tax. The vacation home (in Indiana) maxes at 2% as does the rental house. Commercial would be 3%. Agricultural is 2%.So if you own two identically assessed homes, but one is a vacation home, the taxes will be different. If you own a third home but rent it out, its taxes will be higher still.

Another note, most states now share homestead data and it is unlikely to get a homestead in both.

I did not know that second homes were taxed at the same rate as rentals, good to know.Not exactly. Your homestead home is maxed at 1% property tax. The vacation home (in Indiana) maxes at 2% as does the rental house. Commercial would be 3%. Agricultural is 2%.

Another note, most states now share homestead data and it is unlikely to get a homestead in both.

I have essentially no debt, but I have a very high credit rating still. All monthly expenditures go on an American Express except for those incurred at places too uncivilized to accept AE, where it is usually visa. All bills are paid in full every month and house and cars are paid off as well. All it takes is the discipline to pay the bill, no matter what it is, in full each month. Implied in that is even if it is $7 or $8000 spent on vacation, the money to pay the bill is available - no breaking training for 'special occasions'A credit score is essentially your "I love debt score" and shows how much you like playing kissy face with the bank. Paying down debt lowers your score because the calculation rewards you for borrowing lots of money.

Stop playing the game and stop borrowing money. Then you won't ever worry about your score again.

My next car won't be purchased until I have to start taking distributions and I will pay cash for it

I do agree that such a credit rating isn't valuable to me for the purpose of borrowing as I have no intention to ever have monthly payments on anything again. It does, however, affect things like my insurance premiums

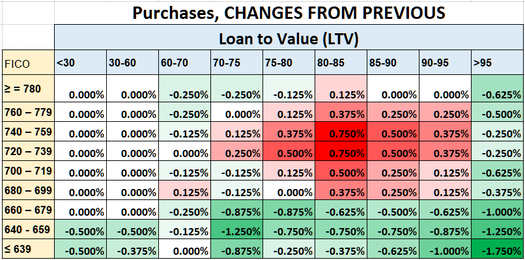

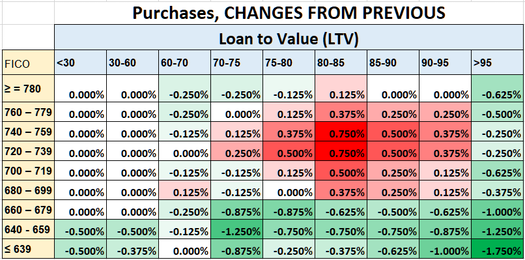

All new rules and schedules on 01 May 2023https://www.mortgagenewsdaily.com/news/01192023-big-llpa-changes from this January details the changes.

In short, lower credit scores still pay more. *surprised face here* The gap is just narrower. People with the best credit stay the same or also get a break in every scenario but one, a change at 80-85% LTV. Note these are the percentage of *change* from the old value, not the new value.

Original source documents from Fannie Mae: https://singlefamily.fanniemae.com/media/9391/display See page 2 of 9 for actual rates. There is absolutely no scenario where lower credit scores get better rates with other factors (like down payment) being the same.

Stop believing the media.

The costs were built to cover the risk of those with lower scores and down payments. So by the posts you have made here it appears you believe that someone that has a 720 score and scraped and saved to get 15% down payment should have their mortgage costs increased while a 639 score and 5% down should have theirs reduced?In short, lower credit scores still pay more. *surprised face here* The gap is just narrower.

Guess I don’t get to participate. I don’t have a mortgage. I have no intentions of getting one in the future. I worked my tail off to be debt free by the time I had the opportunity to retire from my first career early. If I buy again, it will be cash.

I do have mortgages. A few of them. I pay more because they are not owner occupied. I have a great credit score and perfect payment history.

I have no mortgage on my primary residence although I have considered a HELOC. I do not plan to never have mortgages. Using other people's money works for me in this scenario.

I do not like having to pay any extra because my score is higher. I understand, but don't agree with, the fact that my rentals are a higher risk for the banks. I do not understand why there would be any discounts of any kind for people simply because they have lower scores.

There are already a metric **** ton of resources that allow lower credit scores to get mortgages.

I have no mortgage on my primary residence although I have considered a HELOC. I do not plan to never have mortgages. Using other people's money works for me in this scenario.

I do not like having to pay any extra because my score is higher. I understand, but don't agree with, the fact that my rentals are a higher risk for the banks. I do not understand why there would be any discounts of any kind for people simply because they have lower scores.

There are already a metric **** ton of resources that allow lower credit scores to get mortgages.

The last big market downtown featured massive amounts of non-owner occupied properties foreclosed on. When people get in trouble the last thing they let go is the residence, the rentals go early…I understand, but don't agree with, the fact that my rentals are a higher risk for the banks.

I agree that subprime borrowers should not be subsidized. They are subprime because they don’t pay their bills. Not because they live in the inner city or in a country shack. Income has no effect on credit score only on borrowing power, it’s called debt to income ratio.

One fact will remain unchanged. You can’t borrow your way out of debt.

One fact will remain unchanged. You can’t borrow your way out of debt.

Follow up question, is there ANYTHING that it does not appear they are setting up to crash?Seems like they're setting up the next housing crash just like 2008. Loaning money to people that have no chance of paying it back.

TheTrooper

"In valor there is hope" - Tacitus

**** = intentionally disassembling (while we bicker amongst ourselves)The more I look at this chart the more disgusting it is. Look at who the red is, 680-740 credit scores with 10%-25% down. They are ****ing the middle class.

View attachment 273411

Latest posts

-

Second Amendment Scam Group - Dorr Brothers

- Latest: KellyinAvon

-

-

Staff online

-

KellyinAvonBlue-ID Mafia Consigliere

Members online

- DoggyDaddy

- OneBadV8

- blain

- Mike Maddox

- Squid556

- Tradesylver

- COOPADUP

- Count Blackula

- Firehawk

- KellyinAvon

- Simon6101

- baglorious

- BFG

- EODFXSTI

- x34822

- drgnrobo

- BeDome

- El Conquistador

- backtrail540

- fireball168

- boogieman

- Creedmoor

- Brian's Surplus

- CheeseRat

- Magyars

- Dutchmaster

- casselmb

- SouthernStar25

- Trapper Jim

- jcj54

- Rafterman

- Reece'sPieces

- cmamath13

- Squirt239

- phylodog

- bkflyer

- 85Cosmo

- res04

- gottabeoutdoors

- snapping turtle

- slims2002

- Bigdee06

- indyartisan

- EvilElmo

- Cavman

- shadow64

- Myrradah

- yogiibare

- Mgderf

- 42769vette

Total: 1,838 (members: 67, guests: 1,771)