Discover Financial to reportedly track gun store purchases starting in April

Discover Financial Services reportedly proclaimed it will move forward in April to track purchases in gun stores, aiming to prevent firearms related crime.

And replace it with what?This sucks, I've been a discovercard holder for 28 years and have enjoyed the 5% cashback program. I'm gonna have to dump them and when I do I'll let them know exactly why.

Multiple payment processors such as Visa, Mastercard, and American Express have already joined a massive project to separately categorize gun shop sales.

Well yeah, that’s my dilemma.And replace it with what?

From the article

Just wait until Central Bank Digital Currency rolls out. We ain’t gonna be allowed to buy ****.

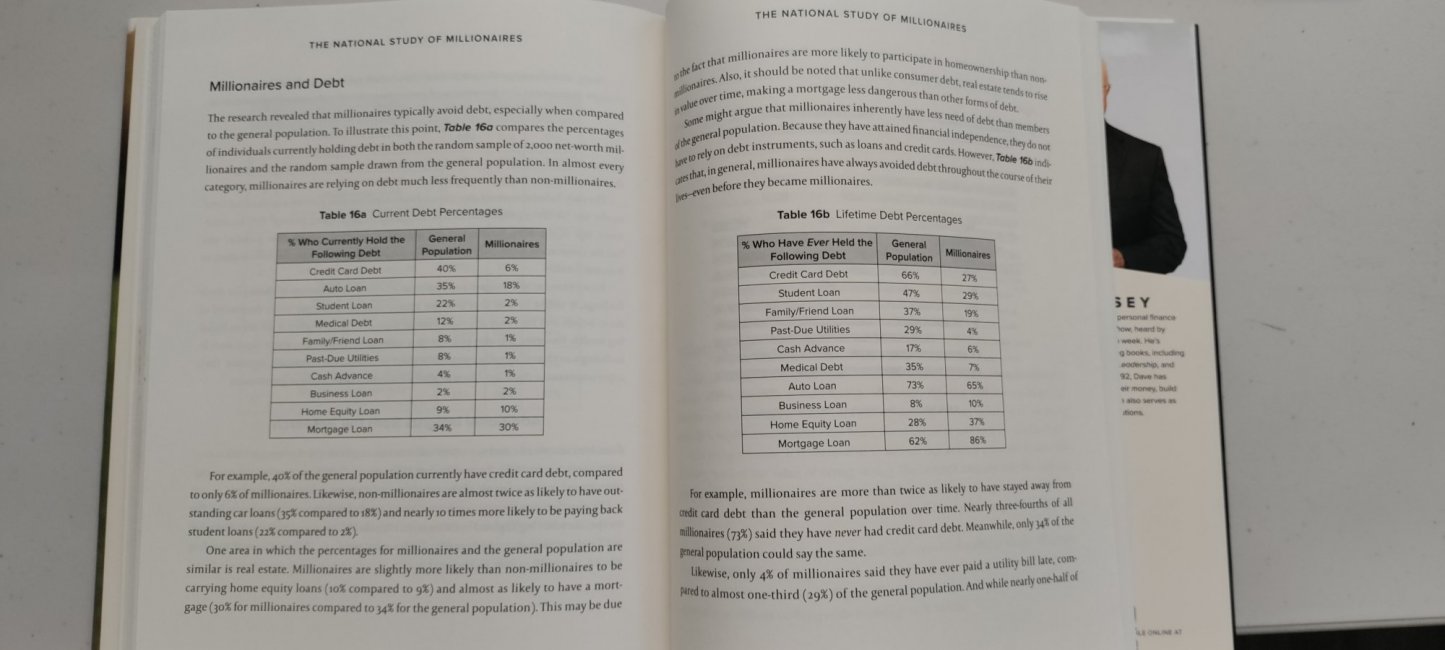

CC can be cash if one is disciplined enough to pay it off early and often. You don’t have to even wait for a bill to pay it down or off. We are up to near $3000 a year in cash back for thing’s formerly paid by debit card or check. BBI gets similar value for his vacations.All that said, I don't use any credit cards anymore since drinking the Dave Ramsey Kool-Aid. Debt is dumb, cash is king and all that.

This is what they do with the data.

Whistleblower: FBI Targeted Innocent Gun Owners Via Bank Of America Records

'Bank of America, with no directive from the FBI, datamined its customer base,' whistleblower George Hill told the House Judiciary Committee.thefederalist.com

Sure.CC can be cash if one is disciplined enough to pay it off early and often. You don’t have to even wait for a bill to pay it down or off. We are up to near $3000 a year in cash back for thing’s formerly paid by debit card or check. BBI gets similar value for his vacations.

My current strategy is ask for a discount for cash, if yes, cash it is, if no, CC it is for cash back…