True, but there's no telling what the car market will be two months from now.

When I decide to buy, I buy/order...

It wont be any better thats for sure.

I hear from other GM's and Sales managers daily how slow they all are.

True, but there's no telling what the car market will be two months from now.

When I decide to buy, I buy/order...

Good luck, and have fun!Cool, I'll check it out. Thx for the tip!

I've bought a couple cars that were previously leased. As stated if someone is interested in a nice yet expensive car, one can be had for down to half of purchase price with only about 36,000 miles on it.Keep an eye open for Certified Pre-owned vehicles. I bought one that was previously a leased car and it has been like buying a new car with the depreciation paid for. I could not have afforded the car new, but even though it was 3 years old, it was like new, with a warrantee and a much lower price.

Per leasing standards the vehicle needs to be maintained per the manufacturer and has to be taken care of. Most lease returns have been taken care of due to the penalties for not taking care of the vehicle. Another benefit of Certified Pre-owned is they come with a warrantee usually for an additional 2 or more years.

DO NOT BORROW ANY MONEY.Thinking about a new car. I'm an original owner of my 2 cars now (bought new) and they've run as long as I take care of them. So I want to buy new or nearly new.

Once I find the car I want, any pointers on buying through a website vs. through the dealership. I heard the stories about how the dealership can jack up the price with add-ons. I know it's a pretty vague question, but been out of the game now for a while any recommendations / pointers would be appreciated.

Went this route in Jan 2020. Bought a 2019 Expedition with 21k miles on it that had been a company car which Ford dealership bought at auction. Saved a ton of money, had a like new car, and am extended warranty. Will go this route again for all future vehicles.I've bought a couple cars that were previously leased. As stated if someone is interested in a nice yet expensive car, one can be had for down to half of purchase price with only about 36,000 miles on it.

This is quality advice. If you already know exactly what car you want, email all of the dealers in a 100 mile radius to request a quote. The online sales guys usually cut right to the chase. Plus, once you have a quote from 2 or 3, you can play them off each other. When we bought our Mazda, we had one dealer give us a quote and tell us to give him last look. When we told him we had gotten a better offer, he asked if we'd let him beat it by $100. I told him the number, and he accused me of lying because he said it was already too good of a deal. No negotiating necessary. Just showed up, signed the paperwork, and left.

For many, that is not an option.DO NOT BORROW ANY MONEY.

DO NOT BORROW ANY MONEY.

For many, that is not an option.

Unfortunately, this is financial suicide.I've come to convince myself that it would be better to buy a new car and pay it off as quickly as possible then trade it every 3 years or so while it's still has warranty left and still in good shape.

Nonsense. It's just an option many aren't willing to choose because it's hard and requires discipline.For many, that is not an option.

Yeah, use that free money to earn a 1% spread while you take a massive 40% depreciation hit in the first three years you own the car. It's trading $40 for $1. Great planIt may also not be sound advice, depending on one's financial situation. A lot of manufacturers offer special financing on new car purchases if you can swing a shorter term loan (usually 36mos). Anywhere from 0% to 3.9% would be helluva deal right now. Even if you have cash on hand, finance the car for <4% and use your cash to buy a CD or save in a money market account currently paying 4.5 - 5.5%. Use their money to earn more money.

View attachment 308598

You might need to go back and reread most of the thread to figure out what's going on here. You and I are talking about two completely different things. Your advice seems to be NEVER under any circumstances should anyone ever consider buying a new vehicle, ever. Mine is, if you do buy new, consider financing if you can get a low enough rate. OP specifically asked about buying a new car.Yeah, use that free money to earn a 1% spread while you take a massive 40% depreciation hit in the first three years you own the car. It's trading $40 for $1. Great plan

No, I'd say new cars are fine if you're already a net worth millionaire and can afford to take the depreciation hit. Otherwise, buying something for say, $40k, that will be worth $15k in 4-5 years is dumb.Your advice seems to be NEVER under any circumstances should anyone ever consider buying a new vehicle, ever.

Trust me, I'm all for keeping my money. But sometimes, buying new is worth more than money. You (usually) also get piece of mind, a longer warranty, and you'll always know every mile, bump, ding, and noise about that car. Plus, you can't put a price on new-car-smell.No, I'd say new cars are fine if you're already a net worth millionaire and can afford to take the depreciation hit. Otherwise, buying something for say, $40k, that will be worth $15k in 4-5 years is dumb.

But it's a free country. Y'all can do what you want with your money. I just prefer to keep as much of mine as I can. It's OK, we can still be friends.

But that return rate will have a lot of catching up to do to get to that 10% average if you started in 2020.Unfortunately, this is financial suicide.

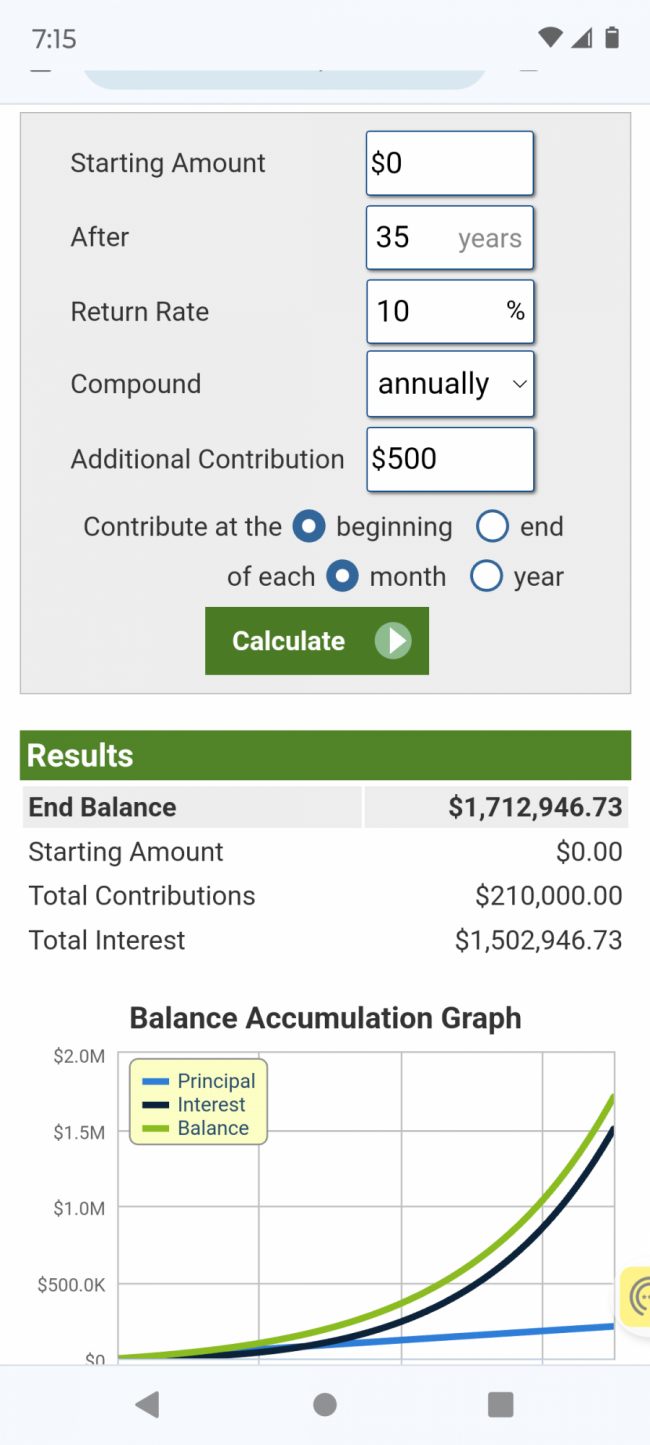

The average new car payment in America right now is over $700 a month, but for easy math, let's assume it's $500 a month.

If you invested just that car payment from age 25 to age 60 in index funds that averaged 10% annually (less than the historical average of the S&P 500), you would have more than $1.7 million.

Buying new cars is what keeps middle class people stuck in the middle class and keeps broke people broke.

My

View attachment 308604

It is ALWAYS an option. Regardless the excuses.For many, that is not an option.

They don't do all that to HELP YOU! They do it for their OWN ADVANTAGE. Not yours.It may also not be sound advice, depending on one's financial situation. A lot of manufacturers offer special financing on new car purchases if you can swing a shorter term loan (usually 36mos). Anywhere from 0% to 3.9% would be helluva deal right now. Even if you have cash on hand, finance the car for <4% and use your cash to buy a CD or save in a money market account currently paying 4.5 - 5.5%. Use their money to earn more money.

View attachment 308598

They don't do all that to HELP YOU! They do it for their OWN ADVANTAGE. Not yours.

I mean, they call it "incentive pricing" for a reason... they want you to buy their car. When they offer a below-market rate with a shorter term, they are targeting a specific segment of the market, namely cash buyers. If you can afford the loan, you're better off taking it than paying cash. That frees up your cash for savings, investments, or paying down higher interest debt (cards, mortgage, etc).

I mean, they call it "incentive pricing" for a reason... they want you to buy their car. When they offer a below-market rate with a shorter term, they are targeting a specific segment of the market, namely cash buyers. If you can afford the loan, you're better off taking it than paying cash. That frees up your cash for savings, investments, or paying down higher interest debt (cards, mortgage, etc).No, I'd say new cars are fine if you're already a net worth millionaire and can afford to take the depreciation hit. Otherwise, buying something for say, $40k, that will be worth $15k in 4-5 years is dumb.

But it's a free country. Y'all can do what you want with your money. I just prefer to keep as much of mine as I can. It's OK, we can still be friends.