You're on the dark web, you just don't know it yet.I'm glad I'm not on the dark web then..

-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

AT&T Confirms Leak Of 73 Million Customers Data On Dark Web

- Thread starter Ingomike

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Which is even more of an issue as we don't even factor into their equation as customers, except for all the credit monitoring that this type of thing facilitates. The credit agencies store and sell our credit data and we are not their customers, but yet they get hacked and the data that they store about us is then used for fraudulent purposes.The credit agencies themselves have been hacked. It is out there…

I get that the data is out there at this point, however, that should not be an excuse or a factor in letting companies off the hook that don't perform the necessary steps to protect data and at least fend off the easiest of hacks.

In the case of Equifax they did get hit with penalties, etc (not sure how much actually made it to impacted consumers.

Equifax data breach FAQ: What happened, who was affected, what was the impact?

In 2017, personally identifying data of hundreds of millions of people was stolen from credit reporting agency Equifax. Here's a timeline of what happened, how it happened, and the impact.

That doesn’t mean the Equifax breach cost the company nothing, though. Two years after the breach, the company said it had spent $1.4 billion on cleanup costs, including “incremental costs to transform our technology infrastructure and improve application, network, [and] data security.” In June 2019, Moody’s downgraded the company’s financial rating in part because of the massive amounts it would need to spend on infosec in the years to come. In July 2019 the company reached a record-breaking settlement with the FTC, which wrapped up an ongoing class action lawsuit and will require Equifax to spend at least $1.38 billion to resolve consumer claims

And in the case of Equifax it was a patch they had not applied in a timely manner:

The attack process started on March 10, 2017, when hackers searched the web for any servers with vulnerabilities that the US-CERT warned about just two days earlier. Two months later, on May 13, they hit the jackpot with Equifax's dispute portal, where people could go to argue about claims.

There, hackers used an Apache Struts vulnerability, a months-old issue that Equifax knew about but failed to fix, and gained access to login credentials for three servers. They found that those credentials allowed them to access another 48 servers containing personal information.

I still can't even get to the log in page. Tried 3 different browsers, page won't even load.I logged right in just now.

They are strangely silent so far, I have received no emails regarding this breach nor are there any alerts on my account page after logging in.

how are you accessing it? Are you just typing in att.com or the full URL https://att.com?I still can't even get to the log in page. Tried 3 different browsers, page won't even load.

Try clearing cache or using complete URL like https://att.com.

This comes up instantly for me at the moment:

https://signin.att.com

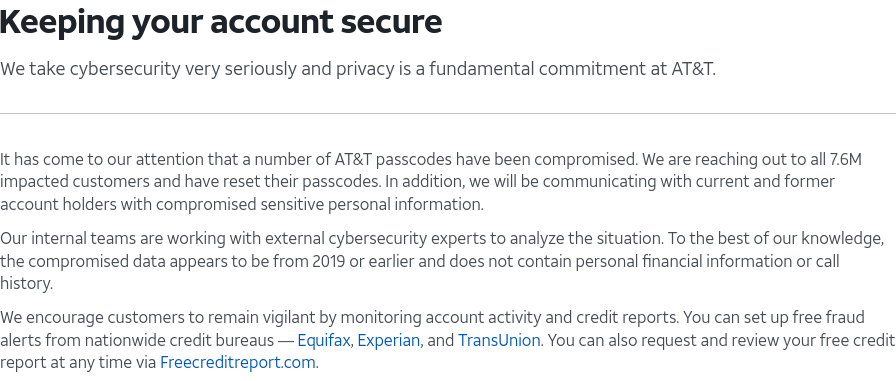

They do have info up about the breach now:

Last edited:

Works on my phone, no go on my desktop.how are you accessing it? Are you just typing in att.com or the full URL https://att.com?

Try clearing cache or using complete URL like https://att.com.

This comes up instantly for me at the moment:

https://signin.att.com

View attachment 343957

They do have info up about the breach now:

View attachment 343958

try clearing your cacheWorks on my phone, no go on my desktop.

Done, no ad blockers or filters, etc. Maybe they're blocking me because I use a poorly secured Internet service - AT&T?try clearing your cache

That's what hackers are trying to do, clear your cash.try clearing your cache

Been having card issues the last couple days, called the bank this morning and my business account was put on hold for fraud. Someone also ordered 3 new cards in my business name. They are guessing it is all part of this AT&T thing.

Keep and eye on your accounts. This blows.

Keep and eye on your accounts. This blows.

Or a microchip.Let's face it, our SS numbers are out there in the wild. If not from AT&T, it would be from some other business or agency. Since our data is so compromised and identity theft so rampant, there's only one way to combat it...

A mark in our right hand or forehead.

snapping turtle

Grandmaster

And the AT&T service outage was not a hack?

Staff online

-

GodFearinGunTotinSuper Moderator

Members online

- Cavman

- Zackerpacker002

- mcoppers

- skydelta34

- JHB

- jkaetz

- zoglog

- ghuns

- AndreusMaximus

- pewpewINpewpew

- Bugzilla

- shootersix

- ws6duramax

- Dmac22

- Timjoebillybob

- Hopper

- Longhair

- 9teen56f100

- Hawkeye7br

- TheGrumpyGuy

- DoggyDaddy

- crookcountygo

- ZurokSlayer7X9

- diverjes06

- bmmyers08

- yeahbaby

- PhantomJ

- FreeLand

- irl104

- aclark

- dsol

- snowwalker

- mondoreli

- OneBadV8

- 66chevelle

- bobzilla

- Tryin'

- bcod151

- dmeadlo

- cavemike

- Liberty Sanders

- medavis428@

- maxipum

- rhamersley

- GodFearinGunTotin

- downrange72

- jabean

- Reale1741

- solarpimp

- klausm

Total: 1,589 (members: 230, guests: 1,359)