dieselrealtor

Master

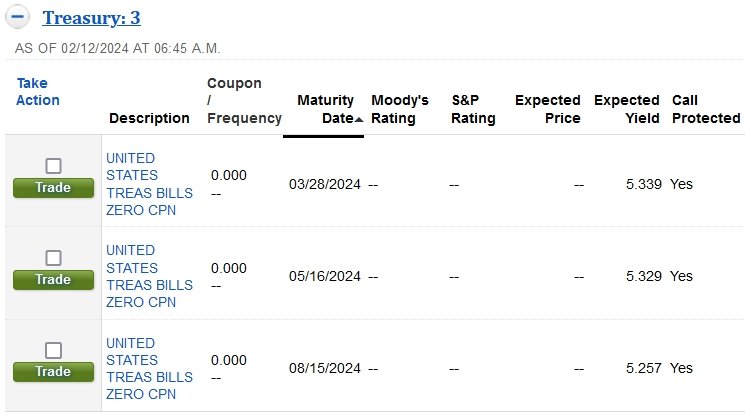

I have done a little looking but haven't turned up results I like yet.

Is there a local (Indiana) institution that offers a decent APY while remaning liquid?

I know there are multiple online banks that are around 5%.

I looked at Old National but they have a big DEI area so don't really want to go there, likewise with Huntington.

Not sure that this is the best category for the post but can't find another one that fits better.

Is there a local (Indiana) institution that offers a decent APY while remaning liquid?

I know there are multiple online banks that are around 5%.

I looked at Old National but they have a big DEI area so don't really want to go there, likewise with Huntington.

Not sure that this is the best category for the post but can't find another one that fits better.