-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Second Largest Bank Failure in U.S. History…

- Thread starter Ingomike

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

Who couldn’t see this coming? Dodd-Frank was relaxed in 2017.

Well, Bawney Fwank, Signature Bank board member, did not see this coming,

"After leaving office and joining Signature’s board, Mr. Frank, a Massachusetts Democrat, publicly advocated for easing those new standards for smaller banks."

Barney Frank Pushed to Ease Financial Regulations After Joining Signature Bank Board

The former congressman and co-sponsor of the Dodd-Frank bill says there is no evidence that the change enabled bank’s failure.

This is why sites like these are important.

So the piece of **** that wants you disarmed also wants you uninformed.

Creatures like Kelly and those of its ilk are a clear and present danger to Liberty.

Authoritarians are going to authoritarian.

Citadel's Griffin Slams SVB Bailout: American Capitalism Is "Breaking Down Before Our Eyes" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

In contrast to billionaire Bill Ackman's praise for the federal government's bailout of SVB depositors, Citadel founder Bill Griffin is not impressed, telling The FT that this action by US regulators shows American capitalism is “breaking down before our eyes”.

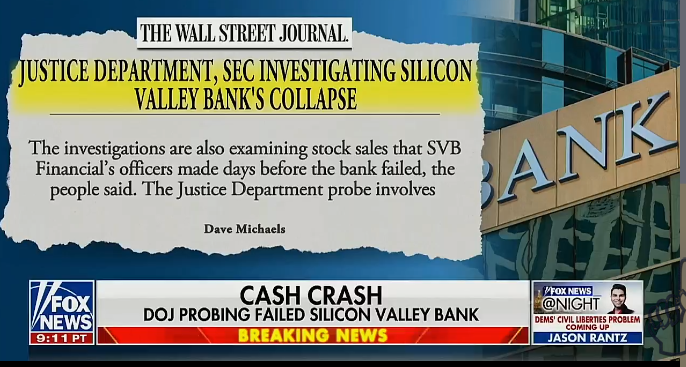

Yet, as The Wall Street Journal's Editorial Board remarks, after venture capitalists (Democratic donors) and Silicon Valley politicians howled, the FDIC on Sunday announced it would cover uninsured deposits at SVB and Signature Bank under its “systemic risk” exception.

Apparently, Silicon Valley investors and startups are too big to lose money when they take risks. They benefited enormously from the Fed’s pandemic liquidity hose, which caused SVB’s deposits to double between 2020 and 2021. SVB paid interest of up to 5.28% on large deposits, which it used to fund loans to startups.

But now the FDIC is guaranteeing a risk-free return for startups and their investors.

Uninsured deposits normally take a 10% to 15% hair cut during a bank failure. Some 85% to 90% of SVB's $173 billion in deposits are uninsured. The cost of this guarantee could be $15 billion.

The White House says special assessments will be levied on banks to recoup these losses.

That means bank customers with less than $250,000 in deposits will indirectly pay for this through higher bank fees. In other words, this is an income transfer from average Americans to deep-pocketed investors.

It's very much communism masquerading as socialism.Citadel's Griffin Slams SVB Bailout: American Capitalism Is "Breaking Down Before Our Eyes" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

In contrast to billionaire Bill Ackman's praise for the federal government's bailout of SVB depositors, Citadel founder Bill Griffin is not impressed, telling The FT that this action by US regulators shows American capitalism is “breaking down before our eyes”.

Yet, as The Wall Street Journal's Editorial Board remarks, after venture capitalists (Democratic donors) and Silicon Valley politicians howled, the FDIC on Sunday announced it would cover uninsured deposits at SVB and Signature Bank under its “systemic risk” exception.

"If this is true, and the WSJ is also reporting it, then this is another Biden scandal. Rather than letting the free market resolve a somewhat ordinary bank collapse, they used the opportunity to nationalize SVB, using tax money to ensure their campaign donors were made whole."

www.zerohedge.com

www.zerohedge.com

'Another Scandal': Biden Admin 'Radicals' Blocked SVB Sale, Nationalized It, Then Blamed Trump For Collapse | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zero

Silicon Valley donates to Democrats, so Democrats will take your money to pay their losses.Citadel's Griffin Slams SVB Bailout: American Capitalism Is "Breaking Down Before Our Eyes" | ZeroHedge

ZeroHedge - On a long enough timeline, the survival rate for everyone drops to zerowww.zerohedge.com

In contrast to billionaire Bill Ackman's praise for the federal government's bailout of SVB depositors, Citadel founder Bill Griffin is not impressed, telling The FT that this action by US regulators shows American capitalism is “breaking down before our eyes”.

Yet, as The Wall Street Journal's Editorial Board remarks, after venture capitalists (Democratic donors) and Silicon Valley politicians howled, the FDIC on Sunday announced it would cover uninsured deposits at SVB and Signature Bank under its “systemic risk” exception.

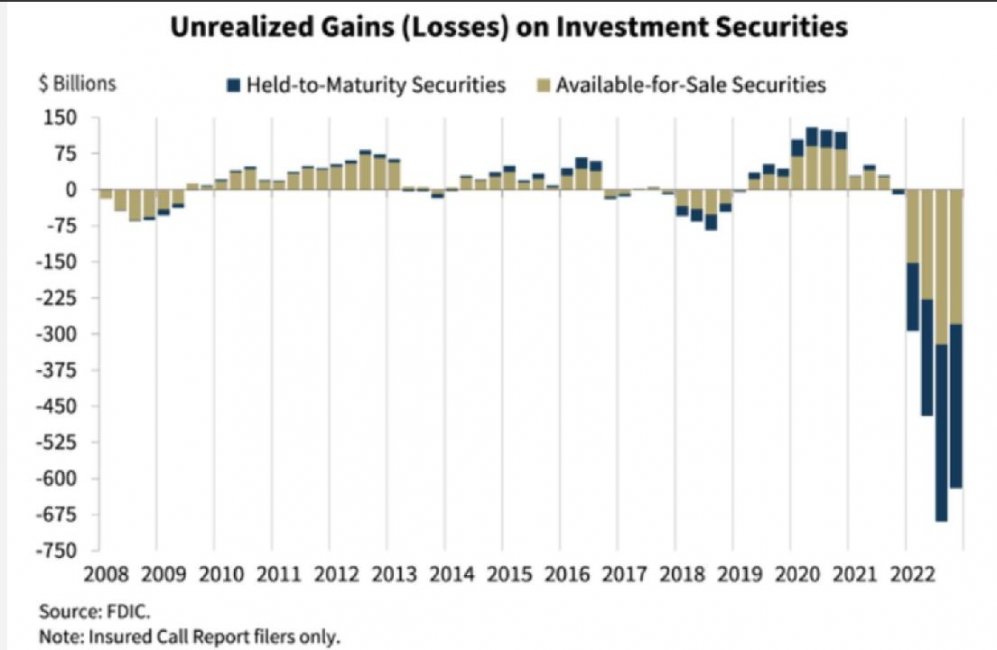

Moddy's rating agency just downgraded well...the entire US banking system. Not a bank or a few banks the ENTIRE system was just downgraded from stable to negative.

www.foxbusiness.com

www.foxbusiness.com

MSN

www.msn.com

Moody's downgrades U.S. banking system's outlook to negative citing bank runs

Moody's has changed its outlook on the U.S. banking system from "stable" to "negative," pointing to deposit runs on multiple institutions, including Silicon Valley Bank.

But there is more!

“Signature Bank, the firm that went under over the weekend, has an expert on its Board of Directors – Barney Frank.”

“Barney Frank was the US Rep behind the Dodd-Frank bill put in place after the 2008 bank crash. The government arguably caused the failure and then turned around and put in a massive amount of regulations in response to the failure.”

If I remember correctly, Frank lobbied HARD in the 80s for banks to relax their standards for home loans, thereby allowing banks to make loans to riskier customers, which led in part to the 2008 crash.

And since Frank has been on the board of Signature, he has been asking the government to relax regulations on them.

If I remember correctly, Frank lobbied HARD in the 80s for banks to relax their standards for home loans, thereby allowing banks to make loans to riskier customers, which led in part to the 2008 crash.

And since Frank has been on the board of Signature, he has been asking the government to relax regulations on them.

Always figured bf spent at least as much time trying to convince his "roomy" to relax his throat.

Experts had recently said the Treasury could stave off a default until sometime between early June and September, depending on the federal government's cash balances.

But Democrats and Republicans could have a much shorter time frame due to the bank collapses, which required the Federal Deposit Insurance Corp to make a record withdrawal of funds from the Treasury General Account.

Unrelated article,but 100% related. If you had any doubt this was a taxpayer bail out of both failed banks last weekend this should end them. They used the treasury general account. Now,why did "banks" not get charged as we were told they would? Ok,that is a bit misleading. Banks were asked to pay it back, they only have 10 years to do so(with no interest)...that means taxpayers payed for and will continue to pay for the "bank" funded FDIC for a long time(doubt it ever changes back to banks being responsible honestly).

www.investing.com

www.investing.com

But Democrats and Republicans could have a much shorter time frame due to the bank collapses, which required the Federal Deposit Insurance Corp to make a record withdrawal of funds from the Treasury General Account.

Unrelated article,but 100% related. If you had any doubt this was a taxpayer bail out of both failed banks last weekend this should end them. They used the treasury general account. Now,why did "banks" not get charged as we were told they would? Ok,that is a bit misleading. Banks were asked to pay it back, they only have 10 years to do so(with no interest)...that means taxpayers payed for and will continue to pay for the "bank" funded FDIC for a long time(doubt it ever changes back to banks being responsible honestly).

Senate Republicans criticise Biden budget amid banking, market strains By Reuters

Senate Republicans criticise Biden budget amid banking, market strains

Latest posts

-

-

NWI INGO General Thread #27 - Fresh Pink Air On US-30 smells like...

- Latest: Midwestjimbo

-

-

-