-

Be sure to read this post! Beware of scammers. https://www.indianagunowners.com/threads/classifieds-new-online-payment-guidelines-rules-paypal-venmo-zelle-etc.511734/

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

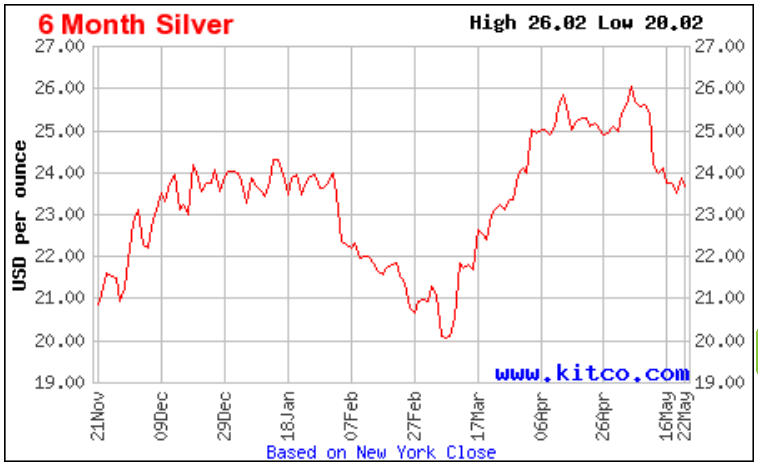

Is Silver next?

- Thread starter Magyars

- Start date

The #1 community for Gun Owners in Indiana

Member Benefits:

Fewer Ads! Discuss all aspects of firearm ownership Discuss anti-gun legislation Buy, sell, and trade in the classified section Chat with Local gun shops, ranges, trainers & other businesses Discover free outdoor shooting areas View up to date on firearm-related events Share photos & video with other members ...and so much more!

Member Benefits:

spencer rifle

Grandmaster

PMs headed down again- buying opportunities ahead?

I’m still waiting for $14 silver eagles to come backPMs headed down again- buying opportunities ahead?

These 1oz bars really tempted me today. I prefer rounds but 1oz bars seem to always be higher priced than rounds. So a surprising deal from Provident. https://www.providentmetals.com/1-oz-sunshine-silver-bar.html

They also had some neat stackable 5oz Silvertown rounds but again I am resisting.

They also had some neat stackable 5oz Silvertown rounds but again I am resisting.

$26.53 as of this posting...These 1oz bars really tempted me today. I prefer rounds but 1oz bars seem to always be higher priced than rounds. So a surprising deal from Provident. https://www.providentmetals.com/1-oz-sunshine-silver-bar.html

They also had some neat stackable 5oz Silvertown rounds but again I am resisting.

Personally, if metals aren’t doing well, I look at that as a sign that the dollar is probably doing better (though not always the case.)OK folks, watch your metal prices now. Keep the faith. The hit we are about to take is only a drop in the ocean. (For physical traders). Looks to me like a good buying opportunity. JMO

I might be the only one here that basically never wants PM prices to go up, because it usually means our dollar is taking a hit. I hold way more dollars than I do PM’s, unfortunately, because I only buy PM’s FTF and with cash and have had limited opportunities to buy that way in the past 10 years.

You're not the only one that sees things that way.Personally, if metals aren’t doing well, I look at that as a sign that the dollar is probably doing better (though not always the case.)

I might be the only one here that basically never wants PM prices to go up, because it usually means our dollar is taking a hit. I hold way more dollars than I do PM’s, unfortunately, because I only buy PM’s FTF and with cash and have had limited opportunities to buy that way in the past 10 years.

I'm not so concerned about the dollar (BACKED BY the full FAITH and CREDIT of the United States government).

I know where the dollar is headed eventually. The swamp creatures can't help themselves, when it comes to throwing a giveaway party on borrowed money. I realize that at this point there are not enough adults in Washington to keep this Titanic from hitting the iceberg ahead.

Value of the USD is in the middle of my concern scale. "Chaos" and all it involves is number 1. Enslavement (in any of its manifestations) is right up there too.

Being your own bank is one thing, but having to be your own law enforcement takes things to a whole new level.

After Biden depleted the Strategic Petroleum Reserve to lower the price of gasoline to save the Democraps in the last election, the problem now is refilling the reserve. Biden and his handlers will spend hundreds of billions of dollars with US oil companies to “save the SPR” and try to look like a hero and not the schmuck that he really is.

Just when you think the government is doing some nefarious programs; it is actually much worse than what you believe.

Just when you think the government is doing some nefarious programs; it is actually much worse than what you believe.

spencer rifle

Grandmaster

Market down, PMs up.

dieselrealtor

Master

and you'll only get mugged if you go downtown

The odds, though small...increase the closer to indy you getand you'll only get mugged if you go downtown

dieselrealtor

Master

Loose reference to Hank Williams Jr songThe odds, though small...increase the closer to indy you get

Last edited:

Hey guys. This thread has been fun to browse. Any big tips to help on getting started? I’ve been watching a lot on YouTube but wanted to ask here.

I decided to get responsible a few years ago and just finished paying off every all of my debt. (House and truck payments still but the rest is gone!) I’ve started some investing (stocks, bonds etc) but interested in some pm possibly?

I’m specifically looking at silver but any real tips to help a newbie?

I decided to get responsible a few years ago and just finished paying off every all of my debt. (House and truck payments still but the rest is gone!) I’ve started some investing (stocks, bonds etc) but interested in some pm possibly?

I’m specifically looking at silver but any real tips to help a newbie?

nonobaddog

Grandmaster

Silver bullets.

(Just kidding - some real advice should be along shortly)

(Just kidding - some real advice should be along shortly)

Wherewolves and zombies? Oh boy…..Silver bullets.

(Just kidding - some real advice should be along shortly)

spencer rifle

Grandmaster

Do a lot of research. What is the cheapest/ounce one day is not necessarily the cheapest the next. findbullionprices is a good start, but you can often find cheaper that is not listed there. Avoid eBay. Check your LCS for deals, and get to know them. Make sure what you buy is content labeled. Junk silver (old American coins) can be a good deal, depending. Indiana taxes anything that is not .999 fine or is not American currency.

Thanks for the reply and tips! I did place one order online already. Sdbullion has a promo for new accounts to get 5oz of their choice at spot (23.79 right now) so I pulled the trigger. Added a couple of the cheapest 1oz rounds I could find to get the order over $200 for free shipping and paid by bank to avoid any up charges.Do a lot of research. What is the cheapest/ounce one day is not necessarily the cheapest the next. findbullionprices is a good start, but you can often find cheaper that is not listed there. Avoid eBay. Check your LCS for deals, and get to know them. Make sure what you buy is content labeled. Junk silver (old American coins) can be a good deal, depending. Indiana taxes anything that is not .999 fine or is not American currency.

It’s official I made my first silver purchase. Came out to $25.37 an ounce for 8oz to my door.

Last edited:

spencer rifle

Grandmaster

SD is good. Monument, SilverGoldBull and Liberty Coin are also good, depending on what you are after.

Staff online

-

texkevAdministrator

Members online

- FN5.7FAN

- cbhausen

- Jim McKalip

- kawtech87

- duboismd

- texkev

- Libertarian01

- XDdreams

- barber613

- slims2002

- partyboy6686

- Fiddle

- Michigan Slim

- LuckyOne

- Cavman

- recentlyadded

- CindyE

- pokersamurai

- jkaetz

- darkkevin

- Luke.Schlatter

- Taeverling

- Pepi

- AndreusMaximus

- Snapdragon

- bwframe

- Scott58

- rabbit hunter mab

- ridetoslide

- rhamersley

- WebSnyper

- hhi7410

- futureofwar

- 7920drew

- tweekie1953

- ws6guy

- Ingomike

- OneBadV8

- Butch627

- mcapo

- NINJA

- Jarvitron

- llh1956

- lafrad

- S1980

- deo62

- Reale1741

- Mgderf

- ratames

- Aggar

Total: 1,404 (members: 231, guests: 1,173)