Please keep in mind much has changed over the years. Bitcoin is now moving in on metals as "a safe haven" reserve. The old rules of finance are being tested in the digitized world. I don't know how that will play out, but I aint buying the story or the Bitcoins.

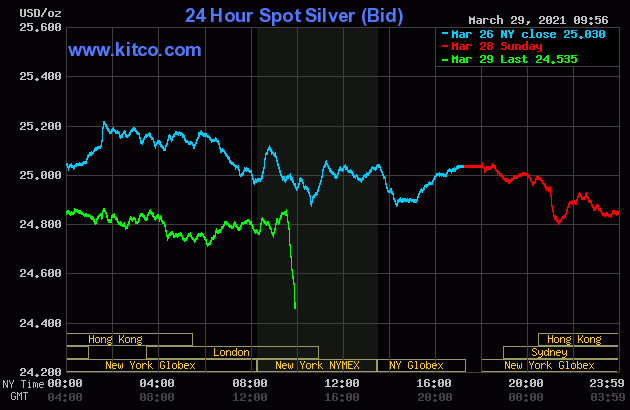

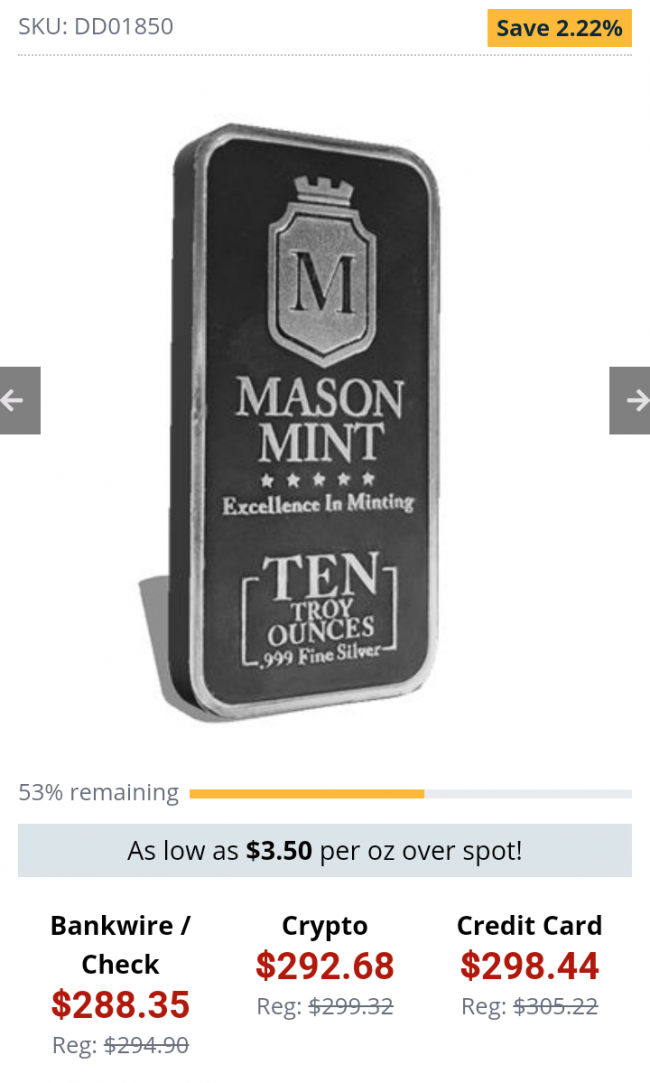

The two things I'm currently looking at is the oil/gold ratio which is still too high, the other is the silver/gold ratio which also is high but dropping. I've been stacking for 20 years. I will trade silver for gold when ratio is around 40:1 from it's present 66:1, or sell the silver high and buy reale state, or sit on it.

One bit of advice I heard long ago from an Italian woman being interviewd on how her old Italian family managed to keep its wealth for centuries. She said they traded gold for real estate or art as the markets and political climate (think WWI and WWII) changed.

She never mentioned fiat currencies or businesses. Just gold, art and real estate. I feel comfortable with that enough to bet my future on it. And remember guns are art and ammo is now a precious metal!

The two things I'm currently looking at is the oil/gold ratio which is still too high, the other is the silver/gold ratio which also is high but dropping. I've been stacking for 20 years. I will trade silver for gold when ratio is around 40:1 from it's present 66:1, or sell the silver high and buy reale state, or sit on it.

One bit of advice I heard long ago from an Italian woman being interviewd on how her old Italian family managed to keep its wealth for centuries. She said they traded gold for real estate or art as the markets and political climate (think WWI and WWII) changed.

She never mentioned fiat currencies or businesses. Just gold, art and real estate. I feel comfortable with that enough to bet my future on it. And remember guns are art and ammo is now a precious metal!

Which reminds me, I need to buy stamps.

Which reminds me, I need to buy stamps.